The South China Morning Post informs us that buyers of new homes in Hong Kong are in for a rude awakening when interest rates rise and mortgage payments eat up 80% of their incomes. Elsewhere in the paper, an esteemed business columnist insists that the city’s property bubble is a long way from bursting – his logic being that serious interest-rate hikes remain years away, and the cost of mortgages is pretty much the sole factor.

It takes a lot for Hong Kong officials, with their institutional and personal interests in high housing prices, to warn consumers against buying. (They are at least concerned about the financial system, and readily urge or force banks to reduce exposure to mortgage business when the market gets too hot.) However, Financial Secretary Paul Chan is voicing alarm and actually mentioning the word ‘risk’.

He is not alone: counterparts in Canada, Australia, the Mainland and elsewhere are increasingly freaking out in their own ways about housing prices. This reminds us that this is not simply a Hong Kong phenomenon. Nor does it stop at real estate. If the SCMP’s Jake Van Der Kamp is correct, we should also expect global equities markets to stay firm. Right?

Jake disregards other variables that could particularly affect Hong Kong property and amplify locally whatever happens worldwide. These include: government land, tax and other policy, and housing as a political issue (and Beijing’s fear of local unrest); the impact of Mainland capital flight/money laundering; and the psychology of the Hong Kong herd.

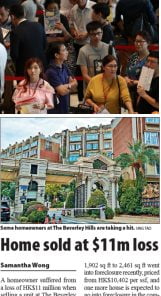

Perhaps this last one struck Paul Chan – a man of humble origins and (we might infer from his icky home/family details) fearful and insecure, deep down, about his social status. He would empathize with the petite bourgeoisie currently lining up to pay HK$20,000 a square foot with 100% financing from the developer. The looks on their faces show innocents struggling to convince themselves that they know what they are doing.

Perhaps this last one struck Paul Chan – a man of humble origins and (we might infer from his icky home/family details) fearful and insecure, deep down, about his social status. He would empathize with the petite bourgeoisie currently lining up to pay HK$20,000 a square foot with 100% financing from the developer. The looks on their faces show innocents struggling to convince themselves that they know what they are doing.

The Standard, like most of Hong Kong’s tycoon-owned media, usually talks up property. But it occasionally reports investors selling at a loss, as a tragic heart-tugging human-interest story that makes a change from donkeys fed to tigers, etc. Today’s is about someone who lost HK$11 million at the Beverly Hills estate near Tai Po. (Note the per-square-foot prices for these second-hand homes, barely half the rates of the easy-financing developers’ new-build projects.)

The Beverly Hills has a reputation as a ‘graveyard’ for property investors. It is a weird development, with lots of narrow town-houses scrunched up on the hillside, like something from a Max Ernst painting. Sort of like Discovery Bay for small-statured agoraphobics who want Li Ka-shing’s mausoleum peering over their shoulder and a view of a Tolo Harbour ship-fuel dump. Judging by the number of the homes’ tiny gardens that are bursting with weeds, many of the units are long empty. It looks very much as if it might more accurately be called Gullible or Desperate Absentee Mainlander Villas.

Maybe this has nothing to do with the mainstream urban areas and new towns. All we know is that, exactly when – and how forcefully – prices move to levels that reflect the economic utility of concrete boxes will remain a mystery. Until it doesn’t.

I am always a little puzzled by HK bureaucrats flaunting of their religious beliefs giving the mainlands disregard for such sorcery. Tsang could need to get to the church quick enough after his release, Paul Man Bo-obs quoting from the bible and Carrie Lam is doing God’s work by becoming CE. Maybe the HK Catholic school brainwashing does work.

How can you write Paul Chan? Surely you mean Bent Cy Croney Lickspittle Paul

” Cupboard Rachman Slum Landlord ” Chan.

And how can you write Jake van der Kamp? Surely you mean Jake ” Why has everyone with a trace of principle around me, even bland crowd pleasers like Nury Vittachi, been sacked yet I am still in a job at the SCMP” van der Kamp.

Arm yourself with facts and get angry. It’s hard to imagine sometimes that I gave you your first online space at NTSCMP.

Oh. And for the thousandth time. Stop talking about property prices. It’s so British and so…Tory!

Pip, pip!

Among certain conservative upper middle-class people, displays of religiosity are part and parcel of upward mobility. It’s sort of like buying a Mercedes Benz and enrolling one’s toddler in fencing classes. I once had acquaintance of an aggressive social climber who announced his religious conversion to his entire department at work in order to angle for promotion. By the time said people get into the upper reaches of the civil service bureaucracy, such behaviour must seem second-nature to them.

Off topic but a great little article in the Free Press that succinctly sums up our lot in the Big Lychee: https://www.hongkongfp.com/2017/06/06/worlds-freest-economy-just-take-look-hong-kongs-supermarkets-utility-firms-taxis/

The Beverly Hills landscape is a dead ringer for the Ernst (guanyin statue actually makes it a bit more dada than Ernst), but the actual development has more of a Bruegel’s Tower of Babel feel — with an implicit nod to Hieronymous Bosch’s Garden of earthly delights triptych, and a pinch of Richard Scarry.

Amazing how easy it is to get financing to buy a brand new flat, when it’s so difficult to get financing to buy a flat on the secondary market, which has also ground to a halt due to the various stamp duty penalties allegedly in place to deter non existent speculators.

It almost makes you think the system is deliberately designed to allow developers to dump micro flats on the market!

@Revolution, sometimes we forget that the sole purpose of the HK government is to take care of the needs of the cartels that run the place. Of course it’s been like this for 175 years.

The big selling point of the Beverly Hills is its clubhouse, where the comprehensive amenities available even include a dog washing room. There is also a Cigar and Billiards room, though apparently no option for those who fancy a game of billiards without being subjected to the stench of cigars.

One oddity is that most of the houses do not include a maid’s room – a strange oversight when one considers that almost every family able to afford a property of this type will employ a domestic helper.