One of the many mundane-but-somehow-bizarre things about the parallel universe that is Discovery Bay is the golf cart. The car-free, whites-only, maximum-security residential compound is good for walking and cycling and has a reasonable bus system as well as taxi-vans. But some of the more overweight, overpaid and over-lazy residents, many of whom sweat profusely just standing and eating an ice-cream, can’t live without powered personal transport. They compete to rent or own one (or sometimes more) of a fixed number of silly-looking golf carts.

One of the many mundane-but-somehow-bizarre things about the parallel universe that is Discovery Bay is the golf cart. The car-free, whites-only, maximum-security residential compound is good for walking and cycling and has a reasonable bus system as well as taxi-vans. But some of the more overweight, overpaid and over-lazy residents, many of whom sweat profusely just standing and eating an ice-cream, can’t live without powered personal transport. They compete to rent or own one (or sometimes more) of a fixed number of silly-looking golf carts.

Way back in history, I recall people laughing when these clunky little vehicles were changing hands for HK$500,000. Since then, they have gone through the HK$1,000,000 mark and beyond. By comparison, this apparently modern, gleaming, high-tech model in the US will set you back around HK$95,000. It’s a fascinating case study in supply and demand; of course buyers are mostly counting on selling later for a profit. Everywhere else on planet Earth, you sell a used car for less than you bought it.

Someone in Disco Bay recently bought one of these golf carts for HK$2.1 million. I don’t know who the buyer was, but I do know who sold it. He is a real estate agent with several decades in his esteemed profession. He has also just sold both his apartments, including the one he lives in; he is now renting and sitting on cash. He is planning to be proud owner of another golf cart and two – if not three – apartments again by this time next year after the Great Crash of 2012-13.

From time to time I take a quick look at the most recent few days’ chatter on Asiaxpat’s billion-mile-long thread on the state of Hong Kong’s property market. Recently, a more pointedly titled ‘when will Hong Kong property drop?’ discussion started. Both contain some interesting debate, and both leave you absolutely none the wiser. (There are distinct property markets. Prices of high-end luxury places on the Peak and of remote New Territories rabbit hutches don’t track each other. For the sake of argument, however, the threads seem to be about what we might call ‘normal’ residential units for non-billionaires who don’t want a 90-minute commute. In other words, the sort of property that rises and falls in price in tandem with Disco Bay golf carts.)

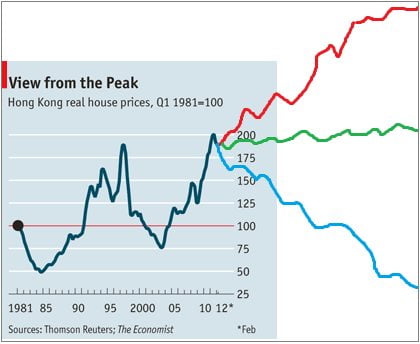

Basically, we are looking at three possible scenarios…

No-one has much time for the middle ‘green’ scenario above, in which Hong Kong property prices just meander along at their current levels. Maybe it’s just too boring, or perhaps it’s just sort of improbable. This subject is compelling because the world is in such a state of flux right now that everyone assumes something serious is going to happen before long, and no-one will get out unscathed.

The happy, positive-thinking, dopamine-infused ‘red’ scenario has prices going up (mostly) and forever (pretty much, at least in terms of the human lifespan). Debasement of currencies is part of the reason, as is the Big Lychee’s status as a uniquely desirable place to launder money live in – like London, Manhattan or Monaco. Local buyers haven’t over-borrowed. China won’t come crashing down, because of its vast latent domestic demand for everything. And our new leader CY Leung won’t do anything to hurt property owners because this is Hong Kong, and it’s just not done.

People have been poking fun at this upbeat argument for years. If they had bought a flat at the beginning, they would be over 60% up by now. With such an impressive track record, it is hard to believe that anyone begs to differ.

But they do, despite knowing that no-one ever made money betting against the Hong Kong property market except with a hefty helping of pure luck in timing. The wrist-slashing doomsday ‘blue’ scenario has prices dropping, and not by some limp-wristed 10%, which belongs in the green line. Obviously, they disagree with all or most of the optimists’ points. They also lie awake at night worrying about Europe.

Some would say that we in Asia don’t need to get too worked up about it. But it’s hard not to get nervous when you see leaders from the US, UK and elsewhere outside the euro zone begging Germany’s Angela Merkel to share her country’s wealth with a continent full of foreigners – something they sure as hell wouldn’t do, if they had any wealth. In some little-noticed remarks some time ago, Merkel said that Germany needed its low consumption and its high levels of exports and savings to look after its own aging population in the decades to come. She didn’t sound like this was a negotiable thing. People are now trying to convince her that Germany’s future generations of retirees and workers would suffer more from Greek/Spanish/Italian mayhem and a euro break-up than they would from just sharing out all their goodies now. As a trained physicist, she is no doubt looking at the idea objectively.

I can’t see any upside and suspect the Disco Bay real estate guy is right – but that’s what I thought 12 months ago and 24 months ago.

The weekend is hereby opened.

Eric Berne said that you can always tell when people are getting old. They talk about money instead of women at the dinner table.

The questions I always used to ask people who live in Discovery Bay were:

What time do you have to be back?

and

Are you on the Escape Committee?

It used to be Surbiton meets Benidorm but perhaps it has changed.

HK’s cyclical property collapses tend to coincide with leadership changes.

Rats ! There will be a leadership change in 2 weeks !!

The predictions about the euro, about China’s rise, about the HK property market have been so often wrong — and the lucky exceptions have themselves had such a poor subsequent record — as to make you suspect the market has a will of its own, together with a department for spreading false rumours.

The chartists, including Hemlock, have an advantage over those who try to explain or predict events if they just try to win more than 52% of the time. If you buy/sell a given currency/non-essential property/shares when they’re well outside their long-term trend line, you put the chances on your side.

A while ago, for instance, I think I recommended buying HSBC at below $60. On the same basis, local property, whether, _pace_ Hemlock, it’s a kiosk on the peak or a palace on an island, must surely not be a good investment at present.

You didn’t mention the gallant attempted arrest of that war criminal Anthony Charles Lynton Blair. Sadly I didn’t know he was in the territory or I would have ensured that such arrest took place. Bodyguards and spooks don’t scare me. Most people think i am one.

You have been warned, Blair. Stay away.

Here is the great Tom Grundy in action:

http://www.telegraph.co.uk/news/politics/tony-blair/9331860/Protester-tries-to-arrest-Tony-Blair-in-Hong-Kong.html

Alas being in the property industry, but yet not knowing much about it, I’m often asked which way prices will go? Upwards! Why? Because it’s Goverment policy.

The only time it goes the other way is due to external factors that our Midas Goverment cannot control. Europe, which has been dragging on seemingly forever, is likely to be one of those factors. I don’t see an off a cliff fall but a decline nonetheless and therefore I suspect Disco real estate guy is also probably right.

With the Weekend opened don’t be tempted into Mr. Li’s personal store;

Pack of 8 Gillette Mach 3 Razor blades in local Chemist $106 in Mr. Li’s Personal store $122 (special price down from $149) $43 buys me my first weekend beer.

Most people think you’re a bore, Bela

RANT starting:

This idiotic government, since the handover, have created a fucking big problem in this town. They have now created 2 very very distinct classes, whose interests are directly opposed.

This is a very stupid and dangerous thing for any government to do, and it was entirely preventable.

All fine and well for those of you who had 1 Million bucks kicking around in 2003. I, and many other young professionals, did not. Is that my fault, sure. But I’m still pissed off at owners here who think 10 % gains on their house every year in perpetuity are normal, and don’t give a rat’s ass if 50% of young middle class Hong Kongers can never get on the ladder.

Pure ‘I got mine, so fuck you.’ Makes me sick to hear them.

Now you’re all buying second houses too, and third ones.

If the government had had any ability at all, just a little tiny bit, with the 1 million tax dollars I’ve paid them the last 15 years, they would have put the brakes on in 2006. Prices would have increased a decent 10-15% by now, and would be reasonable. Everyone would still be pretty happy.

Instead they let this grotesque and unfair enrichment for nothing game for those with houses continue for 9 Years. Yeas, 9 years and ongoing.

Guess you owners don’t give a shit though do you? If there is a crash, I’ll watch in pleasure as the idiots who bought the last 2 years whine about negative equity and get fuck all from CY.

You buy? Be ready to accept losses too. Don’t try to make your losses public. We’ve seen that from other capital owners recently, haven’t we?

And as for those of you who did buy in 2003, good for you,you won the lottery. Just stop acting so fucking smug, and at least show some thought for those around you.

Don’t even get me started on the relationship between home owners and the massive increase in school fees either.

RANT ended.

@ Aardvark

A very justified rant

Most of my money is tied up in HK property , bought at the bottom of the various troughs in the past 20 years, and the surplus is invested in HSBC Sterling bonds ( so if the HK$ ever freely floats that would immediately give me a 30% wipe-out or bonus depending on which way the HK$ goes – up or down , but for sure the British pound will never devalue to zero vs the HK$ / the HK$ will never go infinitely high )

BTW : don’t you all find it rather funny about all these adverts by so-called “financial specialists ” ? ” I made US$2,000 in my first day of trading” sort of stuff

So I am sitting pretty on my little nest egg

But then, what about my son, aged 16, whose highest ambition is to work at McDonalds all his life. ? For him to buy even a rabbit hutch near the SZ border will cost him such a huge multiple of his salary that he surely must rent forever.

Times are changing. CY comes into power in 2 weeks

Carrie Lam dares to challenge the HYK

Is there any chance of an “alternate” march on 1 July to show that I do care but also I think things are changing for the better ?

( Maybe I should march from Victoria Park to North Point with a ” I support CY” banner )

SH1T – just imagine what the next 5 years would have been like under the awful enery tang .

@Aardvark

Good rant Aard. Agree 100%. I think Aard clearly has a point. Wealth in Hong Kong is quite simply tied to cement blocks. I only know 2 classes of people in Hong Kong; those who own multiple properties, and those who can’t even afford one. The lot in the middle are paper thin. Complete insanity. Throw in the tidal wave of Mainland Chinese stashing their stolen loot in Hong Kong and the irrefutable Ponzi element is introduced into the picture. Caveat emptor.

Buy a villa in Spain late summer.

Thanks Aardvark, the end has suddenly got slightly less nigh.

I was going to write this on Friday but thought better of it (either that or the bar opened). However seeing the rants abover has spurred me to write.

Economis lesson 1 – the law of supply and demand: HK is a small place, geographically limited (unless we totally fill in the harbour), and hence there are only so many homes that can be built. Notwithstanding aspirations of the middle class and young persons, the potential for mainlanders to launder money here throug property purchase means there is an increasing demand. Hence, notwithstanding short term corrections, property prices will rise ultimately.

This is free marker economics and if this is what we treasure then I’m afraid we will all just have to suck it up and deal with it.

Rant over.

and I must get a spell checker for the mobile (and a better pair if glasses)….