One of the many inexplicably dumb measures introduced by the Hong Kong government during the SARS/Article 23/Harbourfest era of 2003 was the Capital Investment Entrance Scheme. It was essentially a passport-selling deal of the sort you expect of a country like Panama: ‘invest’ at least HK$6.5 million in local assets (no need to start a business or create jobs) and you get residency.

Amid the trauma and near-rebellion of the time, few people made much of a fuss about it. We were told that Singapore and Canada had similar systems, as if we must always and unquestioningly follow the examples of a micro-country with the highest per-capita rate of executions in the world or a frozen half-continent of poutine eaters. We were told it would ‘bring money’ into Hong Kong, even though the city, then as now, was sitting on more piles of capital than it knew what to do with.

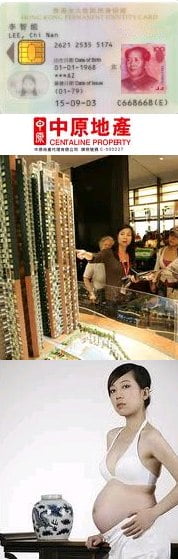

In practice, as policymakers perhaps intended, the CIES was essentially a way to give certain local commercial interests like property developers a way to bundle, at no cost to themselves, a Hong Kong ID Card into their products and thus sell them at higher prices to outsiders. The measure was drawn up against a background of near-panic about the continuing weakness of the property market; there was no telling what officials would do in desperation and blind panic as the city contemplated the unspeakable horror of homes people could afford.

By end-2010, the system had handed out nearly 9,000 residence permits to migrants coughing up HK$63 billion (an average of HK$7 million per capital migrant, meaning that most spent the bare minimum necessary to qualify for their family bolt-hole here). Real estate had accounted for a third of that amount. But in October the government, in response to widespread disquiet about a property bubble, hiked the required sum to HK$10 million and withdrew property as a permitted asset class from the ‘Free Visa With Every Purchase’ scam.

The news today is that applications for CIES have fallen, though funds are still flowing into securities and investment-linked insurance products from people wanting to, in essence, buy a Hong Kong ID Card. Dimwitted politicians quoted in the Standard predictably perceive the decline to be a Bad Thing. The Democratic Party’s Lee Wing-tat wonders whether the migrants might be attracted instead by opportunities to invest in job-making ‘creative industries’ (in fact, owners of new start-ups can qualify for residency under a separate system). The Liberal Party’s Miriam Lau states that many CIES migrants live in the homes they buy here (as if that has anything to do with it) and calls for the government to ‘improve’ the scheme in some way.

No-one considers the possibility that CIES has been a stupid and pointless idea from the start, serving only as one of a thousand options open to the new Chinese ruling class’s diaspora of laundered money, exiled offspring and offshore safety nets

The property developers, we are all relieved to hear, will not be suffering unduly from the tighter controls on capital migrants. In recent years Mainlanders without overseas residency, who are not eligible for CIES, have been buying up Hong Kong real estate simply to get their funny-smelling cash out of reach of PRC authorities; they keep the apartments empty – hence Miriam Lau’s implied logic that CIES is a preferable source of property investor because they occupy their premises.

Meanwhile, private hospitals have started to exploit another way to make money from selling Hong Kong ID Cards: delivering Mainland mothers’ babies on this side of the border. Buy this maternity package from us, they say, and the tax-paying citizens of the Big Lychee will – at no cost to you or us – undertake to provide schooling, medical care and other services to your kid in the years ahead. (And we dump it all on the public hospital intensive care units if anything goes wrong on the day.) If the government auctioned the ID Cards off directly and put the proceeds into the public finances, it would be different. But that’s not what is happening.

Everyone recognizes collusion when the government favours real estate developers over ordinary folk. Most people notice it when a retired civil servant mysteriously ends up working for a property tycoon. Many can spot it lurking beneath the whole high land-price policy arrangement. Some perceptive types detect it in the never-ending public expenditure on giant white-elephant infrastructure projects and small-scale concrete-laying works. A few daring souls ponder the possibility that it is at the heart of the inbound, especially Mainland, tourism market, by which a relatively few landlords and retailers make big profits, and the rest of the economy and community pay the associated costs. But sometimes it is so brazen, it’s staring us in the face and no-one sees it.

Woke up this morning

And Hemlock not talking about property cartel

Woke up this morning

And it ain’t the tycoons any more

Woke up this morning

But I must be still asleep.

Put a new record on honey!

Hemlock, this is the first complaint Donald has heard of during his tenure as people’s servant from 1961: the price of my property is rising, my wife’s Birkin is appreciating so much HSBC is asking for it rather than their 29.99% APR, and my friend Henderson Wong and Hutchison Rasack Mok are calling me for job interviews.

Where, pray, art thou, Alan Greenspan and your seven little dwarfs? Come wreck our economy once more. And bring Blankfein in your pumpkin carriage while you’re at it.

Jobs for nurses, midwifes, and also wives first, second, third and fourth by the way.

But still you read it eh Marma?

9,000 residence permits issued; the police estimated it to be 4,500.