China’s propaganda machine takes a swipe at Hong Kong tycoon Li Ka-shing for selling assets in the Mainland.

Li’s strategy – after raking in easy profits from Hong Kong’s cartelized domestic economy – has long been to buy cash-generating assets at the right time. It means spotting global trends early and thinking on a timescale of decades. A classic move was to buy stakes in  container ports around the world just as the massive 1990s-2000s expansion in international trade was about to take off. Another was to develop major commercial real-estate projects in top-tier Mainland cities just as China was entering its huge (related) boom.

container ports around the world just as the massive 1990s-2000s expansion in international trade was about to take off. Another was to develop major commercial real-estate projects in top-tier Mainland cities just as China was entering its huge (related) boom.

A key part of the strategy is to sell the assets as the global trends are peaking, and move into the next big, undervalued, thing. In recent years, Li’s empire has been reducing its exposure to real estate in exciting, sexy, booming China and acquiring utilities and infrastructure in tired, drab Western countries. This repositioning is based on a simple calculation: China’s easy, fast growth is over, while Euro-zone disasters like Greece can only rebound – if you can think 10 years out. Time will tell, but growing signs of problems in the Chinese economy suggest the timing looks pretty good.

To certain Chinese officials and nationalistic public opinion, the coldness of this strategy comes across as ungrateful and unpatriotic. The act of selling assets should make no difference to China’s economy or people: no-one suffers if Li ‘moves investments out of the country’. Other companies take over the shopping malls, ports or whatever. But we can see reasons for resentment.

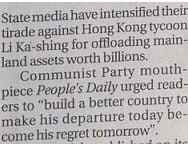

First, there is the perception that Li benefited from personal connections and influence. The famous example is the eviction of a McDonalds to make way for the Oriental Plaza project in Beijing (in which future Hong Kong Chief Executive CH Tung’s family also had an interest). Conversely, Li has donated fortunes to education and other good works in the Mainland. There seems to be an instinctive belief in the Mainland that emotions like patriotism, blood ties or mutual  obligation should override commercial logic or market forces – consider Beijing’s orders to businesses and investors to prop up stock prices. For amusement, we could trace the origins of this attitude to feudal and/or Communist thinking, and maybe even the warped notions of ‘fairness’ arising from the China-victimhood fetish. The sourness of the People’s Daily quote about making Li ‘regret’ is thin-skinned, truculent CCP childishness at its finest.

obligation should override commercial logic or market forces – consider Beijing’s orders to businesses and investors to prop up stock prices. For amusement, we could trace the origins of this attitude to feudal and/or Communist thinking, and maybe even the warped notions of ‘fairness’ arising from the China-victimhood fetish. The sourness of the People’s Daily quote about making Li ‘regret’ is thin-skinned, truculent CCP childishness at its finest.

Most of all, however, Li’s business-as-usual moves are inadvertently delivering a highly unwelcome, politically incorrect message: the Chinese economy has finally jumped the shark.

The Standard manages to turn the story into a shoe-shining opportunity in which Li is praised for the magnificence of his corporate PR team’s space-age reputation-management technology.

Meanwhile – if only Hong Kong bureaucrats could keep up with Li Ka-shing. In the 1990s, when the Pearl River Delta sweatshop export manufacturing powerhouse thing was taking off, it could have made sense to link Hong Kong with the western part of its hinterland. It would have given factory owners new room to expand, and enabled lots of lovely trucks to bring tons of cheap plastic goodies over to Hong Kong’s port for shipping to global markets. Today, the idea is redundant. Yet they are working on the thing, and it seems the reclamation is being rushed and it’s turning into yet another multi-billion screw-up. The good news: ‘the sea wall is not expected to fail but it may not keep the correct shape.’ (Update: more here.)

Does it not occur to the Chinese government that no one will invest in any country unless they are confident of being able to sell off their investment and take profits later should they choose to do so? If investors fear being locked in, they will make sure they stay outside. Maybe the leaders should spend more time talking with all their kids who’ve been packed off to acquire Harvard MBAs, to learn how business works.

Li Ka-shing’s canny commercial decision is viewed as race betrayal. How could a patriotic Chinese undermine the Celestial Empire’s attempts to take revenge for centuries of devilish domination?

All correct-thinking citizens will sit down, work together and hold hands to ensure he clearly understands his incorrect move.

Peter Guy’s scathing editorial on the currency peg one of the finest editorial pieces I’ve seen on the Hong Kong economy in a long time. Highly recommended.

http://www.scmp.com/business/article/1859909/hk-should-devalue-currency-peg

Any visit to Shenzen developers will tell you that about half are bust.

Peter Guy wants to DE-value the HK dollar? I’m not an expert in monetary policy or anything but that sounds completely back-asswards. Our problem is that interest rates are too low, practically zero thanks to the Fed. If you devalue the currency, you’d have to lower interest rates even further. How in hell is that going to help?

All important things aside: last week a new genus of man was discovered in South Africa: Homo Naledi (H. Naledi). In the same week Mount McKinley in Alaska was renamed ‘Denali’.

Naledi is an anagram of Denali. Co-incidence does not exist.

You nailed that one, JB.

If only Park’n’Pay’ would incorporate the Hutch ‘PR team’s space-age reputation-management technology’ at its check outs.

Try getting out of its Whampoa Garden branch on a Saturday afternoon, or any branch for that matter. The till process is pre ‘80s. In a crude attempt to rip off the clients at every opportunity, a price is never the price, the assistant has to whip out a calculator and engage in some complicated process to arrive at the till cost. Then there are coupons, Citibank specials, delivery forms, membership of some secret society, etc to cope with.

Luddites like moi holding out notes of the realm are left open mouthed at the time consuming maze others have to navigate. Even paying with cash does not guarantee a quick exit when you finally shuffle to the top of the queue.

It is not surprising Hutch has lost billions on it telecom business when it cannot even come up with an efficient check out system at its stores.

Here’s a clever trick, Cassowary. Let the FS mumble something that vaguely hints of all the paper work he is having to go through to prepare for the looming HK$ devaluation while having desert wine at his favorite seafood & turf. HK$ will be sold short so quickly that then bank’s will have to pay significant interest to attract deposits in order to finance the shorts. That will at least temporarily crank up interest rates, and then when the treasury has covered all the short players, the FS clarifies that the punters were mistaken, foolish to trust rumors, and need to clear the wax out of their ears.

The Hospital Authority can start handing out NMR scans like they were candy, the airport authority will mass produce runways. The down side is weight of the electrons necessary to hold the sums the treasury made might cause the FD servers to crash through the floor. As to ruined HK reputation, Wall Street & London can’t remember where they parked their penis last week, much less their client’s money yesterday. Greed always thinks it’s more clever than the past morons.

The bridge to nowhere–ahem–Zhuhai, as well as the third runway, are threatening the Chinese white dolphin population.

http://foreignpolicy.com/2015/09/22/are-hong-kongs-pink-dolphins-in-danger/

@Mary Melville – it may be worth the hassle. PNS were recently giving 10% off if you paid a bill over $500 with a particular credit card. That’s a big enough saving to be worth going through a little inconvenience for. And we combined it with another deal giving a big discount on wine purchases over a certain amount.