As a shareholder of Swire Properties, I can live with the HK$475 million apartment in Frank Gehry’s Opus project. Whoever bought it is now the proud owner of a supposed (rather disheveled-looking, to me) architectural trophy. As a transaction, the sale has no connection with the real Hong Kong housing market. The problem is that much of the other residential real estate in town seems to have become similarly disconnected: the city needs affordable dwellings for people and families, but interest rates, government and developers have turned housing stock into overpriced assets – stores of value for investors, if not quick punts for speculators betting on more ‘store of value’ fans joining the rush.

As a shareholder of Swire Properties, I can live with the HK$475 million apartment in Frank Gehry’s Opus project. Whoever bought it is now the proud owner of a supposed (rather disheveled-looking, to me) architectural trophy. As a transaction, the sale has no connection with the real Hong Kong housing market. The problem is that much of the other residential real estate in town seems to have become similarly disconnected: the city needs affordable dwellings for people and families, but interest rates, government and developers have turned housing stock into overpriced assets – stores of value for investors, if not quick punts for speculators betting on more ‘store of value’ fans joining the rush.

Recent land auction results and transactions in middle-class neighbourhoods suggest continued price rises. The property bulls scoff at the question of whether to buy or bail. They point to continued global monetary loosening, which debases the dollar and other currencies, which drives people to convert cash into real assets that will keep their value. Thus more quantitative easing or negative real interest rates must mean yet more upside for the Hong Kong property market. (The rest of the world has gold bugs.)

However, so far as we can see, the ongoing debasement of the currency is counteracting what would otherwise be a severe rebasing through debt-deflation and 1930s-style recession. This must be part of the reason why we are not seeing inflation soar (so far as we can distinguish ‘monetary’ price changes from ‘supply-and-demand’ ones). No-one’s pushing cash around in wheelbarrows to buy groceries. Hong Kong property prices are galloping far ahead not only of inflation, but of most other assets that can protect people from debased currencies.

There may be unique or unusual political, cultural or psychological factors at play. Maybe it is safer or easier to launder dirty Mainland money via Hong Kong property than any other way, so the launderers happily pay double what the asset is worth so the worst-case scenario is that they keep 50% of their illicit millions. Maybe well-off Hongkongers are so sheep-like that local property is their entire investment universe. But even so, how sustainable is it? How long can one asset class in one city outperform so many other assets and locations?

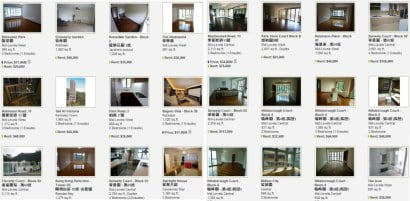

Property bulls like to point out that this time, at least, the Hong Kong property market isn’t over-leveraged as in 1997, when secretaries were buying multiple units with 100% mortgages. But that doesn’t necessarily mean current (or next month’s even higher) prices make sense. How much future debasement of currency has already been priced into middle-class Hong Kong property? What happens if less debasement than anticipated takes place? How long can the nominal prices maintain their distance from the real economic value of these concrete boxes? Or, if the debasement does materialize, what happens to other real asset prices that have so far lagged (and what impact does that have on Hong Kong property)?

It wouldn’t matter if the only thing at risk was a herd of relatively wealthy people with a laid-back attitude to having lots of eggs in just a few baskets. The danger lies in the political unsustainability of these price rises. How many monthly declines in housing affordability will young people put up with before they get angry? How long before, say, a mob of 20-something ‘snails without shells’ burst into a luxury showflat and trash the place in front of terrified Mandarin-speaking apartment buyers? The amazing thing about a recent straw poll on the issue is that 10% of respondents didn’t think housing was too expensive.

Chief Executive CY Leung came into office promising to fix the problem. If he hoped his mere presence would cool the market, he has been proved wrong. Like his predecessors towards the end, he is petrified both of prices going up and coming down. On Planet Earth, cheaper housing is good because it means families have more money left over to buy education, food, shoes, health care, cars, books, plasma TVs, scuba-diving vacations, ice cream, kitty litter, and a million other things. In Hong Kong,  the prospect is sinister and fearful; we would rather talk about cancer.

the prospect is sinister and fearful; we would rather talk about cancer.

Also like his predecessors, CY has an almost-irrational fear – almost a superstition – about cooling the market with words. All he has to tell the public, on prime-time TV, is: “If you want a home, don’t buy at these prices – they’re out of alignment with any sane measurement of the true worth of a concrete box. Just wait.” The last official to do that was then-Financial Secretary Donald Tsang in early 1997. When prices carried on rising for a few months, the secretaries and taxi drivers whined bitterly that he had made them miss their chance. How grateful they must have been a year later.

So – voila: CY’s first stab at solving what will end up as a political crisis at some stage. It’s more PR than anything else, but three things stand out.

First is the reliance on ad-hoc ring-fenced schemes like HOS, MHPP and URA. This is like demarcating little zones on a map in which small numbers of apartments will be effectively tax-free for some lucky winners; the rest of the market remains ‘healthy’ – that is prices can rise or stay stable, but never come down, no, no, no.

Second is the rezoning and other planning jiggery-pokery to convert or redevelop industrial and other non-residential sites for housing. A six-year-old would consider it, but there is a huge bureaucratic hang-up about this sort of thing, based on the colonial assumption that the government’s main job is to extort wealth from the population via land sales. Just minor liberalization is a good precedent.

Third is the ‘Hong Kong land for Hong Kong people’ idea – or lack of it. Some purists oppose the concept by bleating about free markets (where all the land is nationalized?) or even a slippery slope leading to capital controls. A more pressing problem would be the danger of appearing to indulge populist anti-locust feeling at a time like this, and increasing anti-Hong Kong sentiment on the other side of the border. There are also supposed to be implementation and legal issues, too, though other jurisdictions manage it OK.

Long term, CY is no doubt serious about designing a proper system for planning and providing sufficient housing for Hong Kong. After the lurching and panicking and ratcheting-up of property prices under former CE Donald Tsang, anything will look like good governance. But in the nearer term, the policy remains the same: make some gestures and keep your head down for when the market suddenly decides of its own volition to stop being so ‘healthy’.

Hong Kong has less to do with Roxy Music (far too inventive and rhythmical and sung by a cheeky Geordie). The real music for Hong Kong is the Pet Shop Boys, whining, bitchy, cynical, depressing, frustrated, artificial, with all the soul of an IKEA catalogue. i once saw Neil Tennant in Canton Road accompanied by a three-hundred-pound black minder. i said “Hello Neil. You don’t need the bodyguard. No one recognises you here.” He sauntered away.

About twenty years ago I asked some students to give me a Song For Hong Kong. Of course, it had to be RENT! It could have been called MID LEVELS instead.

You dress me up, I’m your puppet

You buy me things, I love it

You bring me food, I need it

You give me love, I feed it

And look at the two of us in sympathy

With everything we see

I never want anything, it’s easy

You buy whatever I need

But look at my hopes, look at my dreams

The currency we’ve spent

(Ooooh) I love you, oh, you pay my rent

(Ooooh) I love you, oh, you pay my rent

But as you almost concede, there already is adequate housing for HK’s people.

The problem is that that housing is divided in to two bands. Band 1 housing is for speculators. Band 2 housing (aka public housing) is for putting a roof over the head of the tea ladies and grunts required to allow the Band 1 speculators from actually having to do any work, like making their own coffee, beyond betting on asset inflation. And CY and company have already stamped their approval on this two band approach.

And why did anyone expect Surveyor CY, ExCo’s property devel expert for the last 15 years of HK govt, to have a property policy that wasn’t bulldozing existing small organic communities to make way for his surveying magic planned communities? Make a dent in the property prices? Create affordable housing in districts with actual jobs with living wages? Nah. But it will make big money for the cronies and craftily avoids the real link between the growth in HK’s money supply and housing prices, because none of the right people want a light shown on where the money’s coming from or going to.

It is obvious that large numbers of flats are being purchased and then left empty, presumably by our friends from up North. The Larvotto development above the shipyards on Ap Lei Chau is an example. At night less than a third of the flats show any signs of lights indicating a tenant, although the entire complex is sold.

If you recently bailed and did very well and locked in a huge gain. Then you predicted a nice glide path down due to China tanking, due to factory output slowing to a halt due to very weak European / U.S demand. Then you dive into the market again when property dropped sufficiently. This would be sensible planning.

On Planet Hong Kong something unique is happening – so analysts’ bleating back to 1997 is useless. Mainlanders are getting their cash out (whether it’s legit or not) and this is the easiest way to do it. CY Leung knows it and China knows what is going on as well. But neither is prepared to do anything about it.

However let us suppose all those mainlanders holding property decide to become HK residents. Add that to the shenanigans in the NT with visa free new towns etc. Then we have the ‘mainlandisation’ of HK.

By god there will be national education then no daft ideas about democracy then and on that thought is the weekend open?

@Walter

This is the same thing that happened in Dubai a few years ago. All the prime USD 1M+ properties were bought by arabs from less stable countries and came with a UAE passport. Nobody lived there – just a bolthole for the owners, who couldn’t be arsed to rent them out. The commercial tenants suffered having paid top dirham for their shops in developments with no residents. End result was a ghost town. Like Larvotto. Only in Hong Kong can a flat overlooking a stinking ship repair yard be “luxury”!

On that note, may I declare the weekend open?

Despite his broken promises, it’s probably in CY’s interest to be seen to be doing as little as possible, as our blame culture will swing into action whether the property market goes up or down.

The surprising thing is the strength here in comparison with other countries. Somehow, HK has managed since the last crash to avoid major falls: because it averages out several other markets, like a basket of currencies? The only other explanation that springs to mind is the short-term, cyclical herd mentality: it’s carried on going up so much, beause… it went up before.

I am waiting with popcorn to seei f a credit crisis erupts on the Mainland, requiring HK based assets to be quickly sold.

A property bust/ banking crisis is waiting to happen on the mainland.

The only questions are: “when ? ” and “how bad ?”.

Bela – your students “humour” clearly carries your imprint. I weep for them.