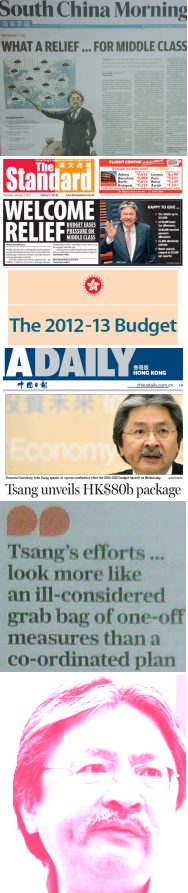

Flicking through the 2012-13 Budget with one finger while jabbing the calculator with another, the little sums of ‘relief’ add up. The government will give me back  HK$12,000 of last year’s salaries tax, paid a month ago. It will boost the tax-free allowance I can earn before tax kicks in by another HK$12,000, saving me HK$1,500 or so. It will pay HK$1,800 of my electricity bills, and waive property rates yet again, leaving me a further HK$9,800 better off.

HK$12,000 of last year’s salaries tax, paid a month ago. It will boost the tax-free allowance I can earn before tax kicks in by another HK$12,000, saving me HK$1,500 or so. It will pay HK$1,800 of my electricity bills, and waive property rates yet again, leaving me a further HK$9,800 better off.

The resulting total of just over HK$25,000 translates into over four months’ salary-plus-housing for my underworked but dutiful amah, or a surprisingly measly-sounding 550 pints of San Miguel outside of happy hour, or a far better-value 3,000 big cans of it from 7-Eleven. Or I could buy a whole clutch of iPads, iPhones, plasma screen doodahs or whatever. And there’s the HK$6,300 handout from last year’s budget, which I have yet to apply for.

In truth, the cash will just go pretty much unnoticed into the pot. Like the Hong Kong government itself, my revenues exceed my expenditure by an embarrassing amount and I always end up with a big surplus (the differences are that I am merely cheap to run, and I can forecast the leftover sum quite accurately). Either Financial Secretary John Tsang shouldn’t have collected the 25 grand from me in the first place, or he should have thought up something useful to do with it. But what can one humble member of the squeezed middle class do?

A variety of robotic accountants and fiscal experts quoted in the press today recite the mantra that Hong Kong’s tax base is ‘too narrow’. It is true that very few people pay more than seven or eight percent of their income in tax; the same goes for companies (also benefitting from yesterday’s ‘relief measures’), most of which mysteriously make too little profit to concern the Inland Revenue Department. John Tsang may have perceived such worrying narrowness when he predicted an HK$8.5 billion deficit for 2011-12. But after he later found he had a HK$67 billion surplus, he could be forgiven for thinking that this is the sort of ‘narrow’ we can live with.

In fact, if we further squeezed the salaries/profits tax base until it were just an atom wide and yielded one penny a year, we could still get by. (OK – it would blow something like a 20% hole in the public finances. But bring civil service pay halfway back into line with the private sector, and voila! We’re back in surplus.) To outsiders, this must look like a deliriously happy state of affairs: this place hardly collects any serious tax from anyone and still has mountains of budget surpluses piling up year after year.

In some ways, it is miraculous; for those of us whose affairs are in order (especially having freed ourselves from the grip of the property scam), the money roles in, and you give the government a little dribble of that, and then the government gives you some of it back again, and there we all are with John Tsang like kids in a bath full of foam, throwing the stuff at each other and in the air.

In other ways, however, we are talking grotesque distortions, not least by which a segment of the population who mistimed property purchase, or simply their era of birth, now carry the weight, via killer mortgages or rentals, for the rest of us. And we are talking gaping vacuums where money should be flowing but isn’t. Billionaires enjoy tax-free investment income, while one Ms Hu and kids talk to the South China Morning Post in an 80-square foot partition and get none of the little public-housing rent waivers and welfare bonuses John Tsang is once again scattering among the poor-but-not-too-poor (her landlord pockets the electricity subsidy).

Naïve, she still has a bit to learn about the Hong Kong way…

In the eyes of the government, they hope we simply don’t exist and all people are tycoons and the middle class…

“…they hope…”?

You’re rich and you breathe toxic air 24/7, you can’t walk in a straight line for more than three yards, your ears are 20 per cent deficient and you can’t open the windows and see anything through the smog and hideous buildings.

Seems you are getting a raw deal, my man. Ask for an upgrade. Some call it getting a life.

We were discussing yesterday the pathetic performance of the SCMP of late, but I beg to differ – at least when it comes to matters which concern.

Today, comparing the non-standard and the SCMP I see some rather daft and trite comments in the standard patting the whiskered buffoon on the back, but in the SCMP both Jake and Tom Holland go to town on pointing out this budget is actually even more silly than last years – the only difference being that Tsang used a bit more smoke and mirrors – or at least enough to bedazzle Mary Ma

But what staggers me is that this idiot FS is so hopelessly bad at planning and forecasting REPEAT FORECASTING that I wonder how he ever got past primary school maths. If he had been employed in any SME company as CA ( not to mention a big company ) he would have been fired for total incompetence years ago

But still he considered competent to run HK’s finances .

Mmmm – says a lot for old Tung’s accountability system doesn’t it ?

Panem et circenses ad infinitum.

When will the government start providing these sort of tax refunds in the form of gift vouchers for buying new apartments, shopping at Park’n’Shop or similar? Surely a think-tank in the pocket of HK’s tycoons must start running a campaign that this sort of fiscal stimulus must be directed into “local economy” rather than potentially being spent across the border in Locust Land or on holidays in places where the duskier people live.

John Tsang submitted a totally predictable don’t rock the boat Hong Kong budget as we all knew he would.

It’s what happens in the next few years where it should get a little more interesting. Firstly you get a new CE who is consistently behind in the opinion polls and a ckufwit. He will appoint a FS, equally as bad as Tsang, who will produce more of the same old same old.

However it doesn’t wash anymore, times have changed, Mrs Hu may soon get the right to a meaningful vote. The property cartel / civil service collusion with added mainland sauce is getting the people all worked up.

The, no honeymoon, CE thinks his inane grin will pacify the masses. I predict not. However I do predict something very similiar to 2003 happening and a new mainland leadership moaning “not again”

BTW I have noticed alot more PLA Soldiers in the barracks formerly known as Gun Club Hill !

Love the subsidy thing for HKE and CLP. Aside from the bleeding obvious handout to the cartels, what about the message it sends to the greenies? Basically it’s giving us an excuse to run our air-cons or heaters more than we otherwise would.

Can we opt out of the $1800 and get cash instead?

I am shocked by the drastic austerity measures revealed by this blog. I always thought you had two amahs, Hemmers.

(PS. When talking of the miracle, I think you may mean the money *rolls* in …)

Why does electricity demand such a special status that it needs subsidy?

Why not water, gas, telephones, newspaper subscriptions or my bar tab as well? This is a market distortion at best (so much for the”world’s freest economy”) and an encoragement for greater environmental damage at worst.

Given HK’s status as a financial hub with the attendant wunch of bankers that follow, it’s amazing that we have an FS who doesn’t understand “O”-level economics. Couldn’t Donald find anyone better?

“‘We have been left out again. It is very disappointing. The government does not take care of us at all. I’d rather see it hand out cash,’ said the new immigrant from Zhaoqing , Guangdong, who lives with her husband, 14-year-old son and five-year-old daughter.”

In this particular case, there seems to be a second issue at stake. If this family are too poor to support themselves in HK, why were they permitted to immigrate here?

No tax hikes, very low tax rates (or no tax at all for most) and a massive surplus.

And still there is non-stop whinging and complaining on this site.

Joe, I think the issue isnt complaining about what was handed out, but more about what could have been done, particularly to help those who really need it.

While HK hasn’t yet reached the lofty heights of Britain’s welfare state, http://blogs.telegraph.co.uk/news/jamesdelingpole/100134365/why-britain-is-stuffed-an-unintentional-masterclass-courtesy-of-the-bbc/ there are some curious differences that exist. For example, I’d say there has been massive growth in arrivals from the sub-continent quickly able to get both CSSA payments and public housing, obtaining further concessions by having a larger family, whilst others remain in cage or divided accommodation with seemigly little chance of respite.

‘If this family are too poor to support themselves in HK, why were they permitted to immigrate here?’

Because Donald has dictated to be a truly World Class City that can compete with New York, Yokyo, London & Shanghai, Hong Kong needs 10 million people – and people with no money, no property, no skills & no education are the sort of welfare needy people that will drag us to a brighter future.

Phuqin’ obvious innit?

I just wish he had used some of the money overloading the government coffers to tackle air pollution. In the long run this would mean less expenditure on hospitals and medical care, never mind that it may help make this a more pleasant place to live. But I suppose you need vision and forward planning for that sort of thing, plus a bit of moral courage.

In other late-breaking news …

“The former head of the Royal Bank of Scotland, Sir Fred Goodwin is to be stripped of his knighthood in recognition of the “the scale and severity of the impact of his actions as CEO of RBS,” according to a Cabinet Office spokesman.

Fred Goodwin, as he will now be known joins an unwelcome list that includes the Zimbabwean leader Robert Mugabe and former dictator of Romania, Nicolae Ceausescu in being stripped of his knighthood”

Since when did the UK govt start giving knighthoods to foreign dictators ( except in HK) ?

Guess it’s time for Donald to give up his knighthood before he is stripped of it for becoming as infamous as Goodwin, Mugabe and Ceausescu

Oh ……. I forgot the famous soviet spy, anthony blunt ( SCMP page 3) .

Good company for no-longer knights of the realm

And talking of non – nights there’s a delicious article in today’s SCMP City page C3 : the new super eco-friendly U-turn house ( sorry, duck folly) at Tamar base has an electricity bill NINE times what was paid at the old govt house, even though the floor space is only 2 x as big

And this on top of legionnaire’s disease and toxic air !

Guess the horse will deny everr being responsible for this either ( we shall soon have to call him the TEFLON horse)

Or……… did he in fact resign as CS precisely to take responsibility for all the bad decisions made in his time as CS ( including the 2011 budget ) ?

hahahahahahahahah

Reckon this years July 1 march is going to be a big one.

@ Joe Blow

A massive surplus is not a thing to rejoice about. A government needs to keep a prudent amount in fiscal reserves for a rainy day, granted, but HK is many times over what is prudent. The rest should be invested in incentives that will bring real value for the future, such as technology, real education, welfare, the environment, sustainable power, health and building infrastructure to cater for an ageing poulation – Sooo many people have said this already – but another year goes by and we get the same old same old.

If you are talking just about this years’ massive surplus then in fact it was a massive miscalculation – the fact that it was miscalculated on the positive side does not make our FS any more competent. BTW I pay tax; last year I paid quite a lot. I have no problem with that at all, but I would like to see it put to good use by people with a brain (well, half a brain would do for now).

@ darovia

Amen

( but even a quarter brain would do for our FS)