The Hong Kong government raises the possibility of criminalizing theft by false pretenses by property developers. The media are focusing on the proposed penalties, and it is true that the idea of property giants’ directors being hauled off for five years in Stanley Prison has a certain appeal, however fanciful. But the real story is what the resulting law will purport to ban and whether it will succeed.

A quick look through the proposal to regulate the sale of first-hand residential properties by legislation gives us a fairly vivid reminder of what the developers have been allowed to get away with under their much-loved self-regulation. The issue, of course, came to a head last year when public opinion finally decided it had had enough of the developers’ blatant cheating (fake floor numbers, fake sales to create fake prices, fake show flats and fake supply shortages to induce buyers to sign sales agreement at midnight).

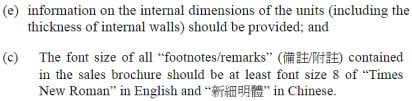

It has long been common knowledge that developers exploited their right to rip off home buyers to the maximum and then some, but it is still galling to see that it will take a threat of prison to force them to reveal the internal dimensions of apartments and make small print in brochures big enough to read…

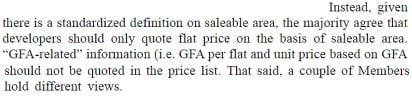

One headline breakthrough here is that the developers will have to quote prices per square foot of saleable area – basically the space within the walls of the property, plus veranda. This will end the ‘GFA’ scam, whereby purchasers pay for each square foot of ‘gross floor area’. There is no official definition of GFA, so developers have been free to add the unit’s share of the hallway, the stairwell, the elevator, the building’s entrance lobby, the mail boxes, the air-conditioning plant, the caretaker’s hovel, and even recreation facilities like club houses, gyms and swimming pools. Hence, say, 700-square-foot flats with 490 square feet of living area.

When you buy a bag of rice that has ‘5 kg’ printed on it, the vendor is breaking the law if the label exaggerates the quantity of the grain or if he adds stones to bring it up to weight. To developers, a requirement to meet such a basic level of honesty is an extreme impertinence and indeed an infringement of their rights. Thus the objection recorded in the report…

(How very touching – that poor ‘couple of Members’. Annex A lists the committee’s painstakingly hand-picked composition; the vested interests from the property lobby were easily outvoted.)

The Standard story quotes the developers’ cartel representative as saying that he hopes the regulations will not be too tight or they will hamper transactions and drag the economy downwards, and a property agency boss as predicting a 30-40% slump in sales should such a law come into force. The implication is that our economy relies on people selling each other concrete boxes. A high-school economics student knows that such trading creates no net GDP. So who cares? Indeed, if Centaline and other property agencies close half their branches, the massive increase in available retail space will give an instant boost to street-level neighbourhood economies all over Hong Kong.

It would be interesting, however, to know what makes these people believe that a requirement for producers to be honest will suppress demand. People didn’t stop buying rice when laws forced merchants to provide what they promised. Will per-square-foot prices be so eye-wateringly painful they will shock buyers into a bit of common sense?

Logically, the proposed law should apply retroactively to the secondary market – that is, the whole existing private-sector housing stock. But this would ‘reduce’ the size of existing apartments (you would see the walls grinding several feet towards you from every direction), which would make existing owners unhappy and burst into tears and stamp their feet, and it would confuse buyers, so obviously we can’t have that, can we?

The property tycoons are putting a brave face on it. Business ethics and human morality are so alien to them that we must assume Beijing gave the Hong Kong government a sharp sword to place at their throats. This proposal dates back to the same outrage in mid-2010 that led textiles scion James Tien to launch a charity for the ragged poor, and the government itself to organize a similar effort. Revolution was in the air.

Note that the proposed changes do nothing to restrict the property cartel’s freedom to collude, or the massive pricing power the developers enjoy thanks to the government’s policy of keeping land for housing in artificially short supply. They will continue to rip buyers off; they will just have to make it clearer.

One thing has changed: China Daily comes up with a funny headline…

Hallelujah !

Lock all of them up ! ( Forever)

There is a strange paradigm in HK where people breaking the law, and sometimes endangering other’s safety are allowed to whine about how any changes will affect their ‘right’ to conduct business (usually inflated of course). For example, minibus drivers not installing seatbelts or running red lights are somehow worthy of special consideration owing to the hardships they face. The sooner our streets are rid of the growing number of real estate agents, the better. (one near my place of work seems to be staffed with badly dressed Mainland looking spivs, smoking on the street).

40% downturn my arse.

I’ll believe it when I see it. Note that these new regulations apply only to first-hand property market, so all developers need to do is to sell it to themselves (under a different company name, of course) then to the first actual owner as a second-hand sale, and will therefore circumvent the regulations. Developers are genetically bred (if that’s not too strong a word) to be unable to tell the truth, or tell right from wrong for that mattter. There is no way they’ll be able to comply.

This is true. I’ve often watched in amazement as developers, psychologically unable to tell the truth, made up a complete cock-and-bull story to feed to some government department or other – even though the truth would actually have been more favourable to their cause. In all cases the feeling was that they simply *had* to try to put one over on government (and thereby the public), or they wouldn’t be able to sleep at night.

They don’t mean to be mean. They just can’t help themselves.

Big Al

I will also believe it when I see it. But this might stop some of the more egregious abuses . I can’t imagine a whole new block of 200 half finished flats suddenly going on the market though some shelf company, which any lawyer can easily trace to the original developer, thus waving a huge red flag. At least with a 2nd hand flat one can see what one is going to buy, and the contract can specify ” sold as seen” which eliminates the worst abuses.

I was in the market briefly at the bottom of the 2008/9 crash to buy a small apartment for rent as investment. I was looking for a 400 sq ft GFA flat in a new building which would rent out at about $7.5K . I got the shock of my life when I saw what “400 sq ft” GFA means in practice : just a bed – sit with only room for a bed, desk and small wardrobe after the space taken up by the shower room and kitchenette. No way to get a table and chairs in there for guests, still less a sofa . Barely 200 sq ft net net. But then for only twice the price I was offered a flat in a much older ( but well-maintained) block which was described is “800 sq ft” GFA , and for that I got a good net 600 ++ sq ft : 2 decent bedrooms, good – sized lounge with ample room for dining table, sofa, big TV, big kitchen, good bathroom and oodles of cupboard space . And that rented for $15K . No brainer as to which one I bought .

Point being that I could SEE what I was buying.

An interesting point was that the 400 sq ft GFA flat was built by a big-name developer ( I think it was Henderswindle or Cheung Cheat) so the “official GFA ” was what the seller had taken verbatim from the original developer. Whereas the flat I bought was part of an MTR station complex and the orginal developer was – presumbably – the MTR. So whatever one thinks about the MTR in general as property developer vs a transport company, certainly the MTR is a lot more honest that the tycoons , and if the MTR can be honest why can’t the tycoons do the same ?

Hope CY wins and has a few tycoons hung, drawn and quartered

Nice story. Nevertheless, the requirement should be imposed on all residential sales, new or used. There’s no moral or logical reason to restrict it to new flats only.

Dagmanit! If mainland China requires property to be sold for their actual size… *sigh* It’s like pissing into the wind. Mind you, at least in HK, the apartment blocks at least have proper foundations? :/

The Hong Kong Elementary Structural Engineering Handbook has an error of three (or possibly ten) magnitudes somewhere on the first page of calculating safety factors. When the next Pacific supervolcano blows, the only thing left standing will be our reinforced concrete infrastructure.

I wonder if the Kwok brothers (evangelical Christian zealots) of the Sun Hung Kai organized crime ring realize they will burn in hell for their deceit?

Similar experience as RTP recently. LOHAS Park, Cheung Gone with your money, alleged 900 sq.ft. real 400 sq.ft if that. One wouldn’t even fit a double bed in the master bedroom and be able to open the door (apartment shown unfurnished in a vain attempt to give an allusion of “space”),

And you probably also wonder if George W. Bush will burn in hell for raining fire and brimstone on the people of Iraq who had nothing (read: Zero.Point.Zero) to do with 9/11 and who did not sit on WMD, even if their dictatorial rulers gave the impression that they did, but in fact, did not.

How slow the wheels grind.

In the early nineties, while I was working for the Housing Authority I was a member of a Consumer Council sub committee tasked with coming up with ‘guidelines’ for sales brochures for developers including – believe it or not – a requirement to include saleable floor areas. There was also to be a requirement to quote prices on a per square foot (or metre) basis using the Saleable Area. In the event the final report was brushed away by the developers and the only sellers to quote prices on a saleable basis were the Housing Authority and the Housing Society.

Two incidentals – the delightful Audrey Eu was also a member of the committee.

And second – there is a definition of GFA – it’s in the Building Ordinance and for the whole building its basically the gross area measured from the outside of the external walls, with some deductions for, among others, electrical plant rooms, refuse rooms and car parks. the resultant GFA is split in the ratio of saleable areas of individual flats to ascertain the individual GFA.

After the Consumer Council, the Law Reform Commission got its hands on the idea and finally LegCo looked at it in 1999 and – surprise – did nothing. See here –

http://www.legco.gov.hk/yr99-00/english/panels/hg/un_resid/report/a1936e.pdf

It is interesting to note that HK has very lax trade practices and consumer protection laws in general, compared with other common law countries like the UK and Australia. The Trade Descriptions Ordinance, for example, does not cover misleading or deceptive conduct in the advertising of services or real property, although it covers goods. Hong Kong adopts a ‘reactive approach’ to consumer law reform and relies more heavily on the common law. Hence, these proposed reforms will be widely welcomed by consumers, particularly in light of scandals such as 39 Conduit.

A simple solution would be to make anyone civilly liable for any misleading or deceptive conduct in the supply of goods or services. no defenes – just if it’s materially deceptive or misleading, pay up for damages caused. Australia’s section 52 of the Trade Practices Act springs to mind but I’m sure other jurisdictions eg the US have similar broad consumer protections laws. That law revolutionised consume protection in Australia. Corporate clients of mine sh*t themselves over their fears of liability. HK could easily copy it if the Govt had the will – the whole provision is about 10 words long – and end once and for all all the corporate deceptive practices of property developers, supermarkets, cable tv and mobile phone companies with their ridiculously complex contracts and opaque contractual offers. Instead, they outlaw itty little bit after itty little bit of outrageous practice and then only after decades of footdragging and consumer outrage. No more Conduit Roads or tortuous laws trying to define arcane sales practices.

This is not a govt that cares for its people over its FC constituents.

Then next step class actions and contingency fees to make it affordable for Chan Tai Man to sue.

Section 52 of the Trade Practices Act (TPA) is now section 18 of the Australian Consumer Law, which is Schedule 2 of the Competition and Consumer Act (formerly the TPA). The wording and intent of the section has not changed however.