The Chinese government is stumbling over itself as it attempts to cover up the incompetence and corruption it allows to flourish by stamping on the people who complain about it – the AIDS scandals, children crushed under ‘tofu’ schools and so on.

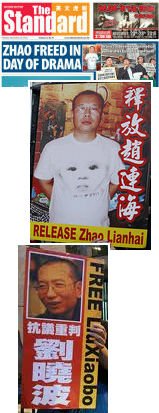

They are trying to wriggle out of imprisoning tainted-milk activist Zhao Lianhai. After giving him a five-year sentence for disrupting social order, Beijing has apparently been shocked by the reaction, not least in Hong Kong where even Communist Party loyalists have balked at the idiocy of jailing the victim. Today’s Standard headline claims Zhao is free already, but it’s probably not that simple. The last time anyone heard from him directly, he was planning a hunger strike. Now he has undergone a mysterious conversion and fired his lawyers via a note relayed by the legal officials keeping him locked away. The politically controlled court system needs to save face through, say, a public apology from him, and a commitment to shut up upon release.

They are trying to wriggle out of imprisoning tainted-milk activist Zhao Lianhai. After giving him a five-year sentence for disrupting social order, Beijing has apparently been shocked by the reaction, not least in Hong Kong where even Communist Party loyalists have balked at the idiocy of jailing the victim. Today’s Standard headline claims Zhao is free already, but it’s probably not that simple. The last time anyone heard from him directly, he was planning a hunger strike. Now he has undergone a mysterious conversion and fired his lawyers via a note relayed by the legal officials keeping him locked away. The politically controlled court system needs to save face through, say, a public apology from him, and a commitment to shut up upon release.

If he refuses, it seems he won’t be alone. The Guardian suggests that the black hair-dye brigade are also ruing their decision to give dissident Liu Xiaobo a Nobel Peace Prize-winning 11-year prison sentence for writing an essay proposing constitutional reform. According to the rumours, they will let him out and into exile overseas if he signs a confession – to which his response is apparently “get lost.” China’s attempts to dissuade foreign diplomats from attending the Nobel ceremony in Oslo have heightened publicity for the case and made Beijing look all the more whiny and insecure. By refusing to allow any family members to accept the prize, China now gets itself bracketed worldwide alongside Nazi Germany. This is several years into a concerted push to boost the country’s friendly image through ‘soft power’ around the world. What would its reputation be like without it?

In truth, China’s leaders have a cast-iron excuse for flinging troublemakers behind bars and sweeping dirt under the carpet: the massive problems they have brought upon themselves in other spheres of statecraft. They are under what must be unbearable pressure.

They have made arrogant and ultimately untenable claims to islands recognized internationally as Japanese, territory that has been far more Indian than anything else for as long as anyone can remember, and the entire open ocean extending from Hainan down to Indonesia. They have pulled an array of underhand legal, commercial and diplomatic stunts in their paranoid struggle to ensure commodities supplies. Countries previously disposed to giving China the benefit of the doubt, and even welcoming its rise, are now hurriedly getting together behind the scenes to coordinate regional military defences against it. This is a once-per-regime national lifestyle choice, and the CCP has plumped for abrasion, hostility and mistrust with nearly everyone else.

At home, the leadership’s focus on keeping itself in power has resulted in an overemphasis on raw economic growth at all costs, including a huge, panicky boost in liquidity that has led to such a level of inflation that people are coming over the border to buy food in Hong Kong. This has two possible outcomes: the bursting of a bubble down the road or a successful tightening in the meantime, sending markets into a gentler dive.

Faced with all this, who wouldn’t toss people complaining about milk in the slammer?

This brings us to a side-show. The Big Lychee’s real estate market has pumped itself up on Mainland and other money and prompted the IMF to voice concerns.

Senior Hong Kong officials, not least Financial Secretary  John Tsang, are walking around in a daze today, scarcely able to believe what they have caused to happen. For years, our leadership has claimed to be aware of Newton’s third law of motion, and even on several occasions spoken about trying it out to see if it really worked. But they have always held back, petrified perhaps of what would result if they… Did Something. (In fact, it is not totally without precedent: the elderly among us still recall the Great Heroic Market Incursion of 1998, when then-FS Donald Tsang freaked the world out by Doing Something that left the government owning a big chunk of the stock market for reasons that allegedly sort of made sense but were never fully explained.)

John Tsang, are walking around in a daze today, scarcely able to believe what they have caused to happen. For years, our leadership has claimed to be aware of Newton’s third law of motion, and even on several occasions spoken about trying it out to see if it really worked. But they have always held back, petrified perhaps of what would result if they… Did Something. (In fact, it is not totally without precedent: the elderly among us still recall the Great Heroic Market Incursion of 1998, when then-FS Donald Tsang freaked the world out by Doing Something that left the government owning a big chunk of the stock market for reasons that allegedly sort of made sense but were never fully explained.)

Then, late last week – moved by the IMF’s words and the growing lamentations of the local public watching housing costs soar – the time came. They took a deep breath. They looked at each other in nervous silence. And… they Did Something. Tighter mortgage finance, and higher stamp duties on people day-trading apartments.

And it had an effect. Predictably, everyone is now complaining about the disaster that takes place when homes become more affordable and the calamity that befalls us when we may or may not have averted another property crash and multi-year deflation/suicide/Armageddon scenario like last time.

Our top officials, weak at the knees and trembling after Doing Something, are now sitting down quietly with a cup of tea and trying to get over the trauma of it all.

Listen to a discussion of the Stupid Stamp Duty at the link above. Exceptional times call for irrational measures.

I mean the link on my name, or this:

http://webb-site.com/audio/Backchat101123.asf

Most governments confuse motion with progress

But David, was this not a reaction to the IMF saying that HK should raise stamp duties to tackle the growing value of HK property?

I agree that something should be done about the shell company loophole, and I also think that modest protectionist measures for non resident property owners should be levied.

If 7% of all property transactions in HK is by mainland residents, then it does indeed have a significant effect, surely.

What about the transactions that are on behalf of mainland residents that we cannot see, or indeed investors from anywhere else?

10% tax on non HK residents buying HK property?

Why not?

I’ve pulled out, but them’s the breaks with a market. I too await the bleating that will go on along the lines of ‘wah, the Government doesn’t care me (insert name of afflicted pillar of society)”.

According to the Inland Revenue’s web-site http://www.ird.gov.hk/eng/faq/ssd.htm#a5 the following bizarre statement, contradicting many years of High Court judgments, is made as follows:

In general, the provisional agreement is not legally binding and the seller cannot transfer any interest in the property to the buyer through the provisional agreement. In law, there is no enforceable right in relation to the property at the date of the provisional agreement. However, if it is provided in the provisional agreement that legal action would be instituted against the party not completing the transaction, it will not be caught by the proposed amendment.

Our Tsang administration confuses lethargy with laissez faire.

To answer Longtimenosee:

1. I don’t think the Govt listens to the IMF. And govt didn’t raise all stamp duties, it is just introducing a a confiscatory rate on resales within 2 years.

2. Nothing should be done about the “shell company loophole” because nothing can be done, except abolishing stamp duty. The government does not know when ownership of an offshore company changes hands, and HK has never taxed offshore transactions. Stamp duty is just a tax on the middle classes, perfectly avoidable by large companies and wealthy people. Click here for more explanation:

http://webb-site.com/articles/stampout.asp

3. That was Churchouse who was saying mainlanders have no effect. I disagree. They do.

4. We shouldn’t go down the path of restrictions or taxation on non-residents owning property. For one thing, if we do that, then we would have to ban or tax all companies which buy property too, because companies can subsequently be sold to foreigners. For another, HK is a free market.

We are in a bubble. Stand back and watch as the market takes its natural course.

The bigger the boom, the bigger the bust.

Now is the time to cash up, and when the bubble bursts, you can buy 2-for-1.

Like taking coke from a baby chuppy investment banker.

Mr Webb, time for a punitive (30% plus) capital gains tax. 1st (main, property you live in) exempt if you are a permanent resident. No exemptions for non HK residents or companies, whether HK or foreign owned. Easy. Property is for living in, not for speculating with.

To answer Tax’em:

1. We cannot tax outside our jurisdiction. Even if we could, we would not know when the shares of a BVI company change hands. Therefore if you tried to tax the sale of HK companies, everyone would just wrap them in offshore shells and trade the wrappers instead.

2. Persons (including companies) who trade properties as a business (or what you might call speculators) are already subject to profits tax. The IRD monitors quick-sale transactions and sends out assessments.

3. The West got itself into the housing mess partly because they taxed gains on almost everything except primary residences. That incentivised people to risk an excessive proportion of their net worth (often several hundred percent, due to the gearing of a mortgage) on their home.

Thanks David for taking the time to answer.

I am not 100% assured, but will chance to brew.

To David Webb

1. I was not advocating taxing the sale of companies whether onshore or not, I was advocating taxing the sale of property. if a BVI or HK company buys property and sells the company, so be it, but the value of those companies will in time come with the tax liability priced in.

2. You may be right (although I an not sure you are about persons trading properties) In any event, this is easily got round

3. The West got itself into it’s housing mess for many more complex reasons than capital gains tax, or lack thereof on the first property. In this respect nothing had changed for umpteen years (apologies for not being specific) In any event, the US/UK housing mess (as I assume this is what you are referring to) is nothing compared to the Hong Kong housing mess 1998-2003, or the Hong Kong housing mess 2012-20??