In Spain, the US and Ireland, vacant homes rot and prices in many areas probably have further to fall. Meanwhile, back on Planet Lychee, the government raises HK$7.6 billion it doesn’t need and won’t spend, by selling two plots of real estate to Asia’s richest man, who will make gigantic profit margins building apartments for sale at sky-high prices to Mainlanders with funny-smelling money. The rest of us look on in wonder. Who, we ask ourselves, are those two guys on either side of the table at the land auction? Especially the one on our right with the World’s-Most-Important-Hong-Kong-Civil-Servant look on his face?

In Spain, the US and Ireland, vacant homes rot and prices in many areas probably have further to fall. Meanwhile, back on Planet Lychee, the government raises HK$7.6 billion it doesn’t need and won’t spend, by selling two plots of real estate to Asia’s richest man, who will make gigantic profit margins building apartments for sale at sky-high prices to Mainlanders with funny-smelling money. The rest of us look on in wonder. Who, we ask ourselves, are those two guys on either side of the table at the land auction? Especially the one on our right with the World’s-Most-Important-Hong-Kong-Civil-Servant look on his face?

For some of us, there is another question: how am I supposed to afford a place to live in? Some sort of expert from a property company on the radio this morning referred to such citizens as ‘lower-tier people’ and seemed to struggle to understand where they fit in amid all this excitement. All he knew was that if the government went back to supplying affordable homes, the economy would collapse and every male resident’s penis would wither and fall off. The Democratic Alliance for the Betterment of Hong Kong proposes direct government subsidies to less-wealthy buyers of small private-sector homes. There is already a subsidy, through tax breaks on mortgage interest payments. Like any such scheme, all it does is enable developers to hike their prices yet further; they pocket the handout, whatever the buyer thinks.

For others, the issue is what to do with the home we have owned for years.

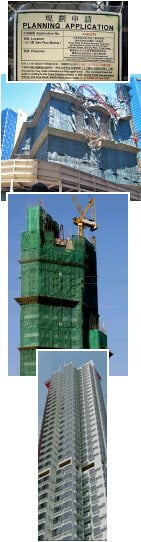

Less than four weeks ago, I mentioned the over-development of the Mid-Levels as real estate companies surreptitiously buy up units in older low-rises until they have enough to force remaining owners to sell; they then demolish the block and cram another soaring tower into that hillside concrete jungle. After lamenting this sad state of affairs, I did admit that…

I’d be lying if the per-square-foot prices [offered to owners] up at Merry Terrace didn’t leap off the screen and yell “Ker-ching! Ker-ching!” into my face. All morning.

Almost on cue – just a few days later – everyone in my tung lau in exotic Soho received a letter from an obscure property agency expressing an interest in buying each apartment. Despite my dismissal of my neighbours last month as “cantankerous, immovable and apparently immortal oldies who won’t budge, ever,” the turnout at an Owners’ Committee meeting yesterday evening  suggested that curiosity has been piqued. We gathered at our friendly local pro-Beijing district councilor’s ward office a few minutes’ walk away to discuss ‘acting in unison’. This is one case where a bulk sale can yield a bonus, not a discount.

suggested that curiosity has been piqued. We gathered at our friendly local pro-Beijing district councilor’s ward office a few minutes’ walk away to discuss ‘acting in unison’. This is one case where a bulk sale can yield a bonus, not a discount.

I don’t see it happening. It is not a big site, thus limiting its value to a potential developer. The building is well under 50 years old, so a predatory property mogul would need to acquire 90% of the place to force holdouts to sell. Also, unlike the graying tai-tais and retired civil servants up the hill in places like Merry Terrace – the real Mid-Levels – many of my neighbours are of limited means. One used to pass through my swish Central former workplace every afternoon with a baby strapped to her back and a vacuum cleaner (she never recognized me in my suit); another is part of the street garbage detail. The bill for a new communal drainpipe draws mumbles of complaint. The idea of hiring a lawyer or agent to negotiate won’t appeal.

That said, those meek old widows in their pyjama suits know they’re sitting on little gold mines. Gentrification set in some years ago, and many apartments in the neighbourhood are now studios rented out at absurd prices (HK$50 psf pm is normal) to gullible newly arrived yuppie types. The most successful investors in this buy-renovate-let business tend to be Westerners; they are not squeamish about old buildings, and they know what bratty kids just shipped in by investment banks want (no clutter, not much need for a kitchen). Local Chinese investors misread the market and the culture, and install horrible all-glass bathrooms, wacky lighting, the inevitable marble and other gimmicks that they think foreigners will like – with disastrous, impossible-to-let results. Anyway, one Western landlord has approached grannies in my building about buying their flats, only to get a price quoted that is pitched exactly at the tempting-but-too-risky level.

They turned up yesterday evening, of course. Offer enough, and the whole building’s yours. But the consensus is that little will come of all this, at least for now. Talk of concerted negotiations with the intermediaries to extract maximum money from the grasping black hands behind the scenes doesn’t get far. The real estate agents send out letters like this all the time. They will get one back that says “make us all an offer,” and then shrugs. My contribution to the discussion is a reminder that Gough Street Market is being turned into an upscale shopping-hotel complex and the Central Police Station cultural-hub-thing will link the neighbourhood straight to Lan Kwai Fong via new walkways. Wait another five or 10 years and let luxury-sprawl and scarcity value do the rest.

One last thing before the meeting is adjourned: a landlord-owner asks the resident-owners not to mention any of this to the tenants. And we go home.

I think on CNBC this morning, someone said “where does Li Ka Shing get all this money to buy these properties from” ? Answers on a ParknShop postcard please…

Local Chinese investors misread the market and the culture, and install horrible all-glass bathrooms, wacky lighting, the inevitable marble and other gimmicks that they think foreigners will like .

I had a Brit friend working here a few years ago and his dippy landlady had installed a floor to ceiling glass wall in the bathroom, right next to the kitchen. When he pointed this out, she then proceeded to hang a curtain…between the tub and the toilet, whilst the toilet was still completely viewable from the kitchen. Common sense, where are you?

Come on, who wants privacy? It’s un-patriotic.

Cynic,

The answer is partly, alas not on the back of a ParknShop postcard, from The Li’s old chums at HSBC …

Unfortunately, we all know the words “common sense” are often not linked in our beloved HK because time and time again it is not actually common.

Talking about apartment decor, I still can’t fathom why an oven is such a rarity in HK apartments – maybe because it’s purpose or operation can not be explained to the helper by the inhabitants! Oh dear…..

Ignoring the politicl problem the HK Govt has about high property prices, how long can interest rates be kept at near-zero without deflation?

Because the HKD is a proxy for the USD, put it another way, depreciating the USD might be a way of paying off US Govt. debt at low cost from the US perspective; but who exactly is going to do the job and buy Treasuries when China is a net seller of them? The Fed?

How long will it be before the market (China) marks Treasuries no longer by the US Govt rating but by the Fed’s rating? Which is the better bet? Which has higher risk? The buyer? Or the seller? Who has unlimited ability to issue debt but limited ability to buy that debt? The US Govt has unlimited ability to issue debt but the Fed (a private organisation) has limited ability to buy the debt.

Put another way, who can China enslave? The Fed? Or the US Govt?

My bet is still on higher interest rates – precisely because of the huge amount of US Govt debt – the elephant in the room. And China will be happy. Because China is the elephant in the room.

That means higher HK interest rates and lower HK property prices.

Merry Terrace is the real Mid-Levels? I am beginning to doubt that Hemlock lives on Conduit Road. The more he reveals, the less tenable his anonymity…

As we all know, common sense should be called rare sense (courtesy of Robert Heinlein) and in HK, it’s really extraordinarily scarce sense as herd mentality rules so distinctively.

And you thought it cannot possibly go worse. Since this April, the ‘mandatory sale’ percentage on a building has been lowered to 80%. Another big win.