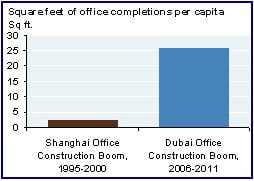

An interesting little bar chart from JP Morgan Private (as in “don’t cut and paste our stuff”) Banking:

The gleaming office blocks going up in Dubai in 2006-2011 contain enough floor area to provide each man, woman and child in the city with an adult-size bed space. Shanghai’s boom a decade earlier added a tenth of that per inhabitant – enough new room to put a pillow in.

Two years ago property firm Colliers were warning about Dubai’s 1-3% vacancy rate and “substantial pent-up demand … yet to find a home.” Rentals in the emirate’s centre were 10th highest in the world, almost on a par with mid-town Manhattan. Now, they are looking at a 50% vacancy rate next year. Prices for residential and commercial real estate have broadly halved.

Where’s all the Schadenfreude? Obviously, right-thinking bystanders can’t help rubbing their hands with glee at the sight of the British carpetbaggers, fat Indian slave-brokers and Ukrainian whores fleeing the Gulf. But the mood is bordering on sympathy for the Al-Maktoum family who created modern Dubai (admittedly, a special sort of sympathy reserved for multi-billionaire feudal despots in trouble – the Germans must have a word for it.)

Unlike many other tribal rulers in the Arabian peninsula, the Al-Maktoums were not peasant goat herders who got rich on oil. They were merchants who saw opportunities for their hometown to make an honest and socially useful living out of international trade. One particular brainwave was transshipment, by which reasonably high-value cargo would zip from the Far East to Dubai across the Indian Ocean by ship and then be transferred to freighter aircraft for swift delivery on to Western Europe. Goods would arrive and depart the same day, which is impressive in a part of the world where arriving three hours late for a meeting is normal.

And, by the standards of many Arab potentates, Dubai’s rulers are a laid-back, cosmopolitan, tolerant and progressive bunch of people. This is, of course, relative; but if you are crazy enough to try to kick-start a trendy, Western-friendly metropolis in any Arab state, this would be the place.

What no-one wants to talk about much here in the Big Lychee is whether we are perched on the doorstep of a ‘Dubai with Chinese characteristics’. Mainland cities like Shanghai have not stopped building since the period shown in the bar chart. To quote consultants Gerson Lehrman:

Commercial property vacancy rates in China approach 50% in major cities. Asking rents have declined by as much as 60% from 2007 with free rent concessions. However, Chinese property values have not declined at all. Moody’s cited values may be down 45-55% from 2007 peak around the world, but not in China. How can Chinese banks with nearly 40% loan exposure to real estate not be impacted by the massive oversupply of virtually all property types?

…No one questions how Chinese bank nonperforming loans have declined to only 1.6% of total lending when they’ve doubled and tripled loan growth since listing in 2003-2004. The issue is not a future asset bubble based on the massive $1.27 trillion lent thru September 2009 but the huge unreported NPL which manifests itself throughout China in empty office buildings, luxury malls without customers, luxury hotels operating at 30% occupancy and thousands of closed factories in the Pearl River Delta.

…The China miracle is fundamentally flawed with over-investment and massive liquidity with an implicit government guarantee which may or may not be honored when the music stops.

Yikes. It is true that you see a lot of empty-looking residential and commercial developments in the mainland. It is also true that plain middle-class folks up there have very few ways to invest wealth; bank accounts pay no interest, capital controls keep funds in-country, and the stock market is a casino – they have almost no choice but to buy a villa and watch the paint peel.

One big difference between Dubai and China is that in the latter the lenders are mainly state-owned, so writing off a ton of bad mortgage debt boils down to another government outlay. And, unlike with Expos or manned space shots, the country at least ends up with a stock of mouldy urban villas, which will come in handy as another few hundred million people move from the countryside to the cities in the coming decade or two.

But if/when a Chinese bubble does burst, will the world’s pent-up Schadenfreude burst forth? For all the debtors’ prisons and trafficking in child camel jockeys, the Al-Maktoums at least meant well, more or less. The Chinese Communist Party’s unlovable combination of vanity, paranoia, inhumanity and menace puts the glorious motherland in a different sympathy-attraction league.

The one-word sentence “Yikes.” which starts the third last para is clear evidence of mispent childhood watching episode-upon-episode of Scooby Doo. Unless, of course, Mr Lychee is in fact the canine’s scaredy-cat side-kick, Shaggy.

–> fairly rocking with mirth.