So – let’s start with the good news…

Phew! Meanwhile, China Daily warmly greets reports that 986 of around 2,800 Shanghai- or Shenzhen-listed companies have suspended trading in their shares to ‘provide a temporary

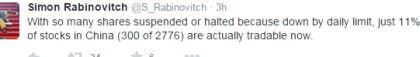

Phew! Meanwhile, China Daily warmly greets reports that 986 of around 2,800 Shanghai- or Shenzhen-listed companies have suspended trading in their shares to ‘provide a temporary  safe haven’ from the ongoing Market Correction with Chinese Characteristics. Hongkongers remember that after Ronald Li closed the stock exchange after Black Monday in 1988, the market plummeted 33% when he reopened it, so the emphasis here is on the word ‘temporary’. It’s like putting off going to the dentist.

safe haven’ from the ongoing Market Correction with Chinese Characteristics. Hongkongers remember that after Ronald Li closed the stock exchange after Black Monday in 1988, the market plummeted 33% when he reopened it, so the emphasis here is on the word ‘temporary’. It’s like putting off going to the dentist.

Commentators are presenting a range of explanations for China’s stock-market bubble-and-decline. At the really exciting end of the scale, millions of ordinary and often uneducated folk believed official propaganda hype late last year, piled into equities on borrowed money, leaving the government desperately trying to prop up the market in order to ward off regime-threatening riots and rebellion. At the relatively more restrained end of the spectrum, big state-owned companies and financial institutions were responsible for most of the leverage and – while they lasted – ballooning stock prices. This being China, no-one is totally sure.

In today’s South China Morning Post, Andy Xie sees the whole thing as a scam among big players to be seen in the context of China’s overall debt – and siphoning-off of debt – problem. To maintain the semblance of a strong economy, the government has commanded credit to flow into infrastructure, into property and now to equities. Much of it has been wasted; some has been stolen. The Communist Party is now finding that even centrally planned holes need to be filled in.

The chances are that China’s financial crisis has begun. The game of ramping up asset prices to cover up bad debts is coming to an end. Deflation will probably take hold. The government will find new ways to roll over debts in commodities and commodity industries. More and more zombies will populate China’s economy. The reforms may be triggered by capital account pressure … As interest rates go down at home but up abroad, a massive outflow is inevitable. That would put pressure on the exchange rate. As international pressure makes it very difficult to devalue, reforms have to unfold to keep money at home.

This is the optimistic scenario. The final reckoning of bad debts gives the government no choice but to implement real reforms. These are reforms that will hurt state-owned and government-linked entities controlled by leaders’ own families and friends, by making them compete with the private sector for financing and market share. Under this optimistic scenario, the government overcomes resistance and inflicts pain on loved ones and cronies for the greater good. No backlash takes place from vested interests or opportunistic enemies of Xi Jinping’s regime. China’s economy is reinvigorated and the next stage of ‘massive boom’ begins.

This presumes cool-headed, confident and determined leadership – not insecure, enemies-everywhere freaking-out. Which brings us back to panicky securities-markets officials who let a third of listed companies suspend trading in order to magically keep the index from falling, a la Wile E Coyote after stepping off a cliff, frozen in mid-air before gravity sets in. Because that sort of delusional regime, after painting itself into a corner, will blame evil foreigners for all that’s gone wrong, arrest people for spreading ‘rumours’, and get so frustrated when stock valuations don’t obey Party orders that they will divert everyone’s attention by invading some Philippine atoll or something, anything, to avoid facing the truth about kleptocracy, markets and life in general. After years of fantasy-creation and making it up as they go along, this could be the real test of the too-big-to-fail Communist Party’s grip on reality and events.

So, I take it that that is the final nail in the coffin for the Shenzhen-HK Stock connect through train, the rail to nowhere and the West Kowloon CNR terminal all in one. China is fucked so we may as well close the door and keep the idiotic fake leadership the other side of their shitty Shenzhen creek.

Obviously the Chinese leadership hasn’t been checking its Dead Cat Doji Candles and Ichimoku Clouds.

I would like to table this motion: in order to support the Glorious Motherland, the DAB and the New People’s Party must invest all their liquid assets in the mainland stock markets without further ado.

Spot on today Hemlock.

Expect mucho sabre rattling and geopolitical provocations in the South China Sea off Vietnam, maybe Diaoyu too …

Chickens appear to be coming home to roost in EU (whose anti-democratic, authoritarian, and generally feckless bureaucratic leadership and institutional nature is becoming exceedingly apparent) and in China. My feeling is these events herald the start of the real global financial crisis (2008 to 2012 being just a historical footnote) as almost all central banks are trapped at the zero bound and have no dry powder and little credibility left to prop up nominal asset prices.

Another example of how all hierarchical systems of authority contain within them the seeds of their own failure, due to internal contradictions. The technological character ( and increasingly thought processes as well) of developed society is increasingly network centric – i.e. evolutionary, intertwined, complex systems of information, ideology and ultimately human action.

Pyramidal hierarchies are going the way of the dodo – a transformation that will deeply challenge most Asian groups and organisations, particularly where a majority of constituents are over the age of 40. Interesting to note that in hierarchies, truth is a matter of power – I am in charge therefore my truth is your truth, or you are dead/imprisoned/organs removed (CCP) or disowned/disinherited/defamed (most Asian families). In complex systems it is impossible to force truth on others: believability in terms of logical internal consistency, emotional or other appeals to belief systems, resonance and hence authenticity, an explicit acknowledgement of personal consent and being “real” become the order of the day.

To attempt to control a non-geographic, non-temporary network of information and communication through force of law (recent Chinese cyber security bill, SOPA in US or TTP/TTiP net and content provisions) or a monopoly on violence is destined to failure: hierarchies will always be playing catch-up against a deck that is stacked against them. And good luck controlling ideology without outright command control of the network (insights that all modern revolutions, espionage organisations, ISIS and recently our own Umbrellas, as well as US technology companies have used to their advantage with holographic cell-oriented organisational structures that are either leaderless or with limited, bounded leadership). A few motivated driven individuals who collaborate based on a shared belief and value system will always out-compete and out-perform the large group who mindlessly obey a single authority or power holder, or who uncritically follow a political or cultural ideology (whether the obeisance is conscious or unconscious matters not).

I do fear though that this dynamic – the collapse of political, economic and social hierarchies – leads to global conflict with the potential deployment of strategic or tactical thermonuclear weapons- i.e. the “WW3” scenario. Although perhaps some evident conflict and trauma is necessary to wake people up to the costs of hierarchy, as well as the unsustainability (and utter stupidity) of our global kleptocratic political economy whose foundations – let’s be honest – are based on the uneccessary and ultimately self-defeating exploitation of the have-nots by the haves, the weak by the strong, the peaceful by the violent, the ignorant by the knowledgeable, the brown and black-skinned races by the white-skinned.

I predict the insanity of these times will be remembered – incredulously -for many generations to come.

See also:

http://www.telegraph.co.uk/finance/china-business/11725236/The-really-worrying-financial-crisis-is-happening-in-China-not-Greece.html

If this does signal the beginning of a 1929 type depression in China we should soon be able to place bets on the date we can stick a fork in the CCP. Unfortunately what comes immediately after is likely to be worse – some China military junta who will follow the playbook of stoking up nationalism and provoking a war. My guess is its Vietnam in their sights, not the Philippines as they still have those ties which will bring American involvement and defeat. If David Shambaraugh is correct and the ‘Chinese Crackup’ has begun it’s not going to be pretty. Suggest watching this one closer than little Greece.

Also, nice line from the Times leader “Shanghai Swoon”:

“Few systems of governance are less reassuring to investors than a meddling one-party state torn between Mao and Milton Friedman.”

Ooops! Hang Seng Index dropped 1458.75 points or 5.84%. Let the panic commence!

To follow on from Monkey Uncensored’s excellent observations, the CCP leadership is necessarily living in a fantasy world due to the SNAFU principle of Celine’s Laws (as formulated by the wonderful Robert Anton Wilson):

1. National Security is the chief cause of national insecurity.

Because secret police have incredible powers, every secret police agency must be monitored by a more elite secret police agency. And so on ad infinitum. This means thousands and thousands of people are paid to spend all day being suspicious of everyone, and finding traitors everywhere. This means: a) they have to find some traitors by any means necessary, b) they don’t trust anyone at all.

2. Accurate communication is possible only in a non-punishing situation.

Or “Communication is only possible between equals”. In any hierarchy (business, government, military, etc) people and employees inevitably distort the truth of reports when dealing with their superiors, in order to avoid any punishment for relaying bad news. As a result, the superiors operate from a distorted view of the situation. This effect is magnified exponentially as you go up the hierarchy, so that those at the top have the least realistic view of the situation, but by dint of being at the top, have to pretend to be omniscient and infallible.

3. An honest politician is a national calamity.

Dishonest politicians are only interested in lining their pockets at the public expense. Honest politicians are interested in change through politics, which primarily means making new laws. New laws always create new criminal classes. More laws mean more criminals. There are now so many laws enacted that in fact pretty much everyone is a criminal, and no one can actually be sure if they are or not, because the number of laws make it nigh on impossible to find out. By adjunct this also means that if the government looks hard enough it can find anyone it wants to be a criminal.

hold on to your seats folks this could get bumpy

The only mitigating factor I can think of from my very non-expert perspective is, as noted by some commentators, that the Chinese stock market is not a big part of the overall economy. Should this be at all reassuring? What’s the exposure of the banks?

Great post by Hemmers. You hardly need consult many more sources than this blog.

And so, Beijing gets it’s first knock on the Reality Door. Now the Comrades know how Washington felt in 2008 (and 1973 and 1929 and etc). I agree it’s probably going to end up with something to distract the masses.

At the end of the day taxing slavery only gets you so far…

@ Monkey Uncensored. Golly some good posts you have, we really must do a beer some time.

This is just China joining the current Western model where we prop up markets and failing banks through government intervention (i.e. taxpayers money) as some sort of support directly opposed to the caveat emptor maxim of investment.

As a result, all this does is encourage investors to continue in the blind faith that their original investment is effectively guaranteed. Hence when the bubble well and truly does burst (as in the Greek scenario for example) and it is beyond the pockets of the government guarantor to do any more, than the catastrophe will be ultimately greater for all than if the pain that might have been borne now.

This is a story to watch for many months to come and (fingers crossed) could be the ultimate undoing CCP rule in China. (or is this just wishful thinking?)

I have switched most of my cash to a large American bank.

It’s not as though the CCP doesn’t have a history of surviving total economic collapse. If they survived the Great Leap Forward and the Cultural Revolution, they’re likely to survive this. Regimes don’t collapse of their own accord because things get awful, otherwise Mugabe wouldn’t still be in charge of Zimbabwe. They collapse when a viable challenger surfaces and wins. You either need a credible external challenger, or you need a palace coup. The latter is the most likely in China, for obvious reasons. Which also limits the scope for real reforms. Palace coups generally result in reforms only if the new leaders perceive them to be in their best interests. Either they have a pressing need for international approval, or brute force isn’t an option and you need some quick-acting legitimacy to avoid dying on a lamppost. Neither of those situations apply to China. So the most likely scenario should Xi get the boot is another CCP oligarchy with a thick layer of bullshit, obfuscation and intimidation to carry them through the recession.

Cass, the “viable challenger” will be the Chinese middle-class who will -at one point- no longer put up with the “Long March” crap, the Marxist-Leninist crap, the “Great Helmsman” crap or any other “Party” crap.

For LRE:

http://dilbert.com/strip/2015-07-12

A good corollary: There are no non-punishing communications in a hierarchy, it’s just a matter of which end is getting burned.

@Cassowary very good point. I was kind of thinking that this latest lawyer-roundup rodeo the CCP has been running has been a way preemptively cutting the feet out from under any prospective middle-class empowerment movements ala Taiwan in the 1980s