Many of us look at the activities of ultra-wealthy Mainland Chinese at home, here in Hong Kong and abroad…

…and, after wondering at their tastes, ask ourselves where, exactly, the money came from. What underlying economic activity produced it, and through which routes did the fortunes ultimately flow into these particular hands? In most cases, it is totally impossible to say. Scale such enigmas up many millions-fold, and you have the Chinese economy itself. Even in developed, open societies, figures for gross domestic product can only ever be approximate and even if technically accurate are still notional in practical terms of people’s welfare and happiness. In China, where officials at every layer of government can simply make numbers up, we’re all clueless.

Thus we are told one minute that the whole place is a pyramid of debt about to collapse, and the next minute that it has a few bumps ahead but will move on to its next, consumption-led stage of growth with few problems. Even the government in Beijing probably has no idea. And that’s before you try to factor in potential demographic disaster left by the one-child policy or the difficulties of reconciling the economic and other interests of the Communist Party and the nation.

Economist Andy Xie’s crystal ball is no better than anyone else’s, but he is at least pretty blunt. He thinks China’s massive property and land bubble will deflate – gradually, like Japan’s. Lower property prices will leave more money in people’s pockets, focus investors on real wealth-creation and may even boost export competitiveness a bit. Some rich folk are going to get seriously hurt, but provided Beijing lets that happen, the country will adjust and be in line to hit US$20,000 per capita GDP by 2030.

The big ‘if’ here is whether China’s leaders would let their own families and friends go bankrupt; this article was originally in Caixin and presumably potentially subject to Mainland authorities’ censorship, which may be why Xie doesn’t mention it. Beijing has to end a system that forces the general population to subsidize well-connected businesses. Transitions from feudalism, aristocracy and robber barons in the West show it can be done, but it could get, let’s say, interesting. (As an aside, note amusing parallels with Hong Kong: a) the benefits of lower land and property prices; b) the system by which we all have to subsidize a few tycoons via cartelization.)

Even if everyone eventually lives happily ever after, China is still in for some near-term upheavals. Craig Stephens thinks Beijing could help wean the country off increasingly pointless investment but keep growth going from the overall populace’s point of view by devaluing the Yuan. In terms of impact, this would be a speeded-up, partial version of Xie’s decline in land and property prices, with the added bonus of probably being harder for vested interests to resist.

The US and Europe would not like it. They must be starting to notice that Chinese protectionism is getting, if anything, more systematic and nationalistic, whether it’s keeping Despicable Me 2 out, shaking down foreign companies like GlaxoSmithKline, or buying up overseas resources-based assets for what look like blatantly strategic reasons. Would China risk a global trade war? If it’s the only way of avoiding choosing between the Party and the nation, would it have an alternative?

Now, getting back into our cozy little safe Hong Kong home: what would devaluation of the Yuan mean for us? My own crystal ball sees some positives. Hong Kong groceries like Yakult would rise in price in Renminbi terms, so cross-border trading/smuggling would be less lucrative. Similarly, local hotel rates and luxury goods prices would rise in RMB terms, possibly further reducing visitor numbers and giving us a badly needed break from the tourism menace. And Hong Kong property would be revalued in Yuan, reducing any remaining incentives for Mainlanders to buy local apartments, and giving past buyers a bigger RMB payback if they sell. There’s even a bit of icing on the cake: a weakening of the Yuan could have the psychological effect of making it look less suited as an eventual global reserve currency/trading medium/etc, and we’ll hear less of the tedious blather about Hong Kong being a Renminbi business blah-blah hub, which will be a tremendous relief to us all.

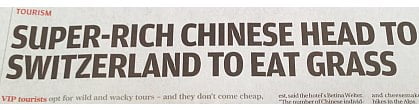

Out there in the big wide world, of course, as China goes through its coming rocky patch, all hell could be breaking loose, in which case it’s hard to imagine any Hong Kong company, investor, employee or retiree coming out of it unscathed. Maybe we’ll all end up eating grass. Or maybe not. As I say, we’re clueless.

I once said to my Swiss former mother-in-law: “Hong Kong may be a terrible place to live, but Lugano is a great place to die.” I then picked up my daughter and got on the plane to Zurich and back to Hong Kong. When they offered me a Swiss passport, I declined. Obviously, the Chinese have a lot to learn about the land of short fat inbred bores.

In the 1980s, do you remember them, Japan was going to rule the world. Where are they now?

In 2013 it is China.

In fact, when 350 million Arabs get together and form democratic Governments (it is coming) they will rule the world by 2100. Oh yes. They already own or could buy most of it.

Enough of this fashionable concentration on fad irremediable, backward cultures which are hidebound and cannot change. They are permanently doomed. The Arabs are on the rise. Even Al-Quaeda armed by the US and A cannot crush Syria.

http://www.youtube.com/watch?v=c3I3ahtwrZE

Bela of Arabia offered and refused a Swiss passport? That’s a good one!

The thing about bubbles is that they don’t “deflate”, because they’re bubbles.

My hunch is that the Pekingese are so hidebound, so blinded by their own chauvinistic rhetoric, so determined that China is independent of the laws and rules that govern the rest of humanity, that they must be heading for a big fall.

The only question is whether, given the proportion of GDP devoted to suppressing information, lucid individuals will be able to detect the first signs of systemic change, whether economic, social or cultural.

Life’s too short to be bought, Wilhelm. After seven years of marriage they have to give you one. I went to China instead. All the foreigners I knew in Switzerland had given up life for death with benefits. I prefer living.

Comments seem a tad slow today.

“Ein grosser Aufwand, schmählich! ist vertan.” as they would say in Switzerland if they could understand Goethe.

China’s economy – the world’s biggest ponzi scheme.

GSK doing what every foreign company in China does. Play the game or die.

Some of us have to work for a living, Dr Adams (how’s the family, by the way ?). Something you as a teacher/academic/terminal bore wouldn’t understand.

Something even Hemlock as a cossetted company gwailo who doesn’t do anything specific, wouldn’t understand either. Do you realize that most, if not all, the Chinese staff in your company hate you ? You wouldn’t know from the happy smiles they give you everyday. The ones with the most festive “Goo’morning” in the elevator, they hate you the most.

I see Blow Job is his usual pleasant, racially non profiling, informed and witty self today…..

Uh oh. I’m in trouble.

I got several cheery “goo mornings” today and I hadn’t even left the flat.

Does anyone have Wendi Deng’s divorce lawyer’s number handy?

Still, I shot 78 at Fanling and no protesters in sight. Another day in CCP paradise.

Pip! Pip!