The SCMP reports the government’s eagerness to get LegCo election voting numbers at or above the 30.20% achieved last time…

Hong Kong’s leader has called on the public and private sectors to encourage employees to vote in the coming Legislative Council election, describing it as their social responsibility.

RTHK says…

Chief Executive John Lee and the head of Electoral Affairs Commission (EAC) David Lok on Thursday jointly called on voters to cast their ballots in the Legislative Council elections on December 7, saying the polls will directly affect their daily lives and shape the city’s future.

At an event to mark the beginning of the election process, with the nomination period to begin on Friday, Lee said electing capable, responsible lawmakers is crucial, as many policies require legislation or funding.

“I call on and expect all institutions, enterprises, and organisations in Hong Kong to respond enthusiastically, and actively fulfil their social responsibilities, encouraging and providing conveniences for employees to fulfil their civic responsibilities by casting a sacred vote.

Memories of lawmakers who held the executive branch to account – or criticized it – are still fresh. With no-one but pre-selected ‘all-patriots’ now on the ballot, some might see not voting as a way to protest. But for many it might just be a question of what or who is there to vote for? The candidates are few in number; you’ve never heard of them; and all you ever hear of LegCo is its automatic support for the government.

From the Standard…

The State Council’s Hong Kong and Macao Affairs Office has commended outgoing Hong Kong legislators for making way for “new blood” as the nomination period for the city’s eighth Legislative Council election began on Thursday.

In a commentary published under the pen name “Hong Kong and Macao Ping,” the office warned against interference by “anti-China troublemakers” while praising the political transition.

“The successful holding of this election is of great significance and far-reaching impact for accelerating Hong Kong’s transition from order to prosperity and better advancing high-quality democracy suited to Hong Kong’s reality,” the article stated.

It noted that some members of the current legislature had chosen not to seek re-election to facilitate the transition between generations of patriotic forces, showing “noble spirit and exemplary conduct.”

The commentary highlighted broad social consensus supporting the improved electoral system and recognition of the seventh Legislative Council’s performance, with expectations that the upcoming election would further demonstrate high-quality democracy.

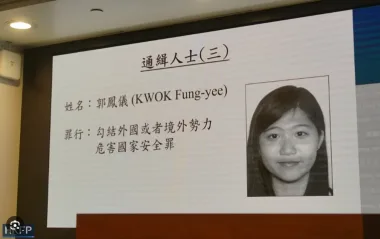

However, the article cautioned that “anti-China troublemakers have never stopped interfering with and sabotaging elections, and Hong Kong society must remain vigilant against their resurgence.”

It recalled how these elements had previously collaborated with external forces to disrupt elections through smear campaigns, misleading polls, and even violent threats before the electoral overhaul.

Maybe that will change everyone’s mind and boost turnout.

Some weekend reading…

HKFP report on an exhibition on LGBTQ history in Hong Kong in the 1980s-90s.

The National Catholic Register on why Hong Kong’s Catholics deserve better leadership from the Church.

From AP, the story of a diary written by a Chinese sailor seconded to the Royal Navy on D Day…

Sleuthing by history enthusiasts Angus Hui and John Mak in Hong Kong pieced together the story of how Lam found himself aboard HMS Ramillies and proved vital in verifying the authenticity of his 80-page diary, written in 13,000 wispy, delicate Chinese characters.

…One breakthrough was their discovery, confirmed in Hong Kong land records, that the abandoned 9th-floor flat where the diary was found had belonged to one of Lam’s brothers.

Another was Hui’s unearthing in British archives of a 1944 ship’s log from HMS Ramillies. A May 29 entry recorded that two Chinese officers had come aboard. Misspelling Lam’s surname, it reads: “Junior Lieut Le Ping Yu Chinese Navy joined ship.”

China Media Project on Beijing’s official line on China’s economy…

When it comes to China’s economy, the future has never been brighter. That is the point forcefully made this month by a series of eight commentaries published in the official People’s Daily, which repeatedly stress that “to believe in China is to believe in tomorrow.” The articles were written by Zhong Caiwen (钟才文), a very prominent economic expert that no one on earth has ever heard of — because, of course, he does not exist.

Zhong Caiwen is a pen-name for a collaboration between writing groups at both the Central Propaganda Department (中宣部) and the Central Financial and Economic Affairs Commission (中央财经委员会), the bodies within the Chinese Communist Party that are responsible for political messaging and supervision of the financial system respectively. Such homophonous pen names are common in Party-state media, allowing powerful departments to voice official positions while signaling their authority to other Party insiders.

…this bold declaration of confidence, republished by multiple media outlets within China, suffers from a fatal flaw hardwired into how China’s ruling Party continues to communicate even well into the 21st century — a kind of repetition complex. If someone reassures you that everything is just fine, you relax: Good, that’s good to hear. If they say it again, there is a frisson of doubt. And when the reassurance comes a third time, it begins to sound like something other than confidence. You are sure there is much more they are not saying.

Foreign Policy looks at the apparent contradiction between China’s technological prowess and its underlying economic stagnation…

The split screen of techno-wizardry on one side and empty apartment complexes and struggling villages on the other conveys valuable yet only partially accurate pictures of a complex country.

…In many cases, both the upward signs and the worrying ones may seem unconnected but are really two sides of the same coin…

…the high-tech push has not translated into maintaining rapid growth and a stronger macroeconomy. After the boom-boom years of 1980 to 2010, China has seen an uninterrupted 15 years of slowing growth and rising debt—and the tech push is part of the problem.

…China’s sweet spot is moderately difficult technologies that can be tweaked and improved incrementally and then sold in massive amounts at low margins. China has had more difficulty in the most complex, advanced technologies where economies of scale are less valuable.

(Such as commercial aircraft, complex fine chemicals, quantum computing, and high-end precision machining.)

…As capital has been drawn to priority sectors, investment in areas that might produce greater employment or income growth has been crowded out … China lags far behind in many high-value-added service sectors. Among the most prominent are healthcare and education, labor-intensive sectors that would soak up urban employment and provide services that would strengthen human capital.

…China has one of the most poorly educated labor forces in the upper-middle-income world … it will still take decades to achieve the levels that South Korea and Ireland had when they were middle income and striving to move up to high-income status. No country in the world has successfully moved from middle- to high-income status with the low levels of aggregate human capital that China has today.

Also from AP – a report on the increasingly bizarre anti-science movement in the US, discouraging vaccination, fluoridated water and other public-health measures…

On raw milk, bills would allow for sales beyond farms in Arkansas, decriminalize its sale in Hawaii and let Oklahoma farms sell raw donkey milk.

Having grown up next to a dairy farm, I have been in cattle sheds – where the animals are milked. The places are ankle-deep in cow shit. If you oppose pasteurization (or vaccines, or fluoride, or washing your hands), you are a moron. Wellness influencers and Putin love you. More…

Less than a week later, Emily Marris’ toddler, Brooklyn, was hospitalized and nearly died after drinking raw milk.

The Southern California mom did research online, finding a homesteader Facebook group and buying raw goat’s milk from a seller who called it “clean and tested.” Retail sales are legal in California.

Brooklyn ended up on dialysis and a ventilator, suffering three cardiac arrests before finally turning a corner. She now has high blood pressure and walks with a limp.

If these people want to kill themselves, that’s great. But I feel sorry for the kids.