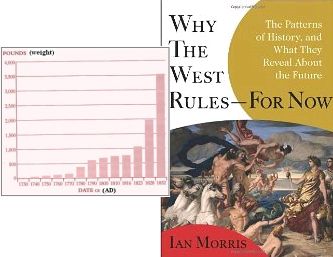

…taken from Why the West Rules–for Now: The Patterns of History, and What They Reveal About the Future by Ian Morris, shows the amount of opium sold by – or perhaps we should say eagerly bought from – the British East India Company in Guangzhou as China’s protectionist trade policies, aimed at accumulating cash as an end in itself, soaked up the supply of silver. In today’s world, at least before China’s current account surplus suddenly vanished in the first two months of this year, the Middle Kingdom effectively exchanges exports for IOUs from the US Government repayable in a currency that will have shrunk significantly in real value. The West rules because others let it?

Archives

Search

Recent Comments

- Mark Bradley on Horse-racing for kiddies. (We’re not desperate!)

- clucks defiance on Horse-racing for kiddies. (We’re not desperate!)

- Mary Melville on Horse-racing for kiddies. (We’re not desperate!)

- Young Winston on Horse-racing for kiddies. (We’re not desperate!)

- Twelve Monkeys Zero Concerts on Horse-racing for kiddies. (We’re not desperate!)

- James` on Horse-racing for kiddies. (We’re not desperate!)

- Young Winston on Horse-racing for kiddies. (We’re not desperate!)

- Reader on A viewing and listening day

@HKBigLychee on Twitter

Maugrim correct.

3,500lbs is a ton and a half – seems like a paltry amount to have caused an awful lot of fuss over the years – presumably the numbers rise beyond 1832…

Gotta say I agree with Jason90.

Evidence that the weight was *much* more abounds. E.g. from this link:

http://www.serendipity.li/wod/hongkong.html

We get this …

“Opium sales had risen gradually from 2,330 chests in 1788 to 4,968 chests in 1810. But once the British got a monopoly, they forced it up to 17,257 chests in 1835, worth millions of British pounds.”

It is a well-known fact that Chinese chests are not very big. Maybe that explains the apparent under reporting (just 3,500 lbs for 1832).

Hemlock & ilk would just LOVE to restart the opium business, I suspect. LOL. Dream on…

I wonder what a graph would look like for other similarly moreish Western-introduced products, like cigarettes, McDonald’s, XO, Bordeaux, et al.

I was right then?

Do I win five Great British Pounds?

Opium will do fine – I know people.

@ANON What price are you offering?