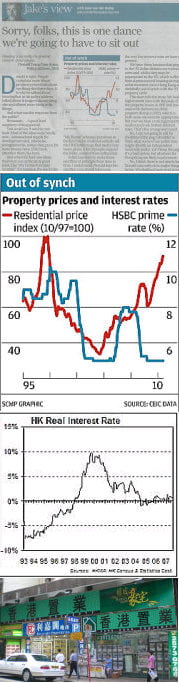

Inestimable South China Morning Post columnist Jake van der Kamp writes that there is nothing the government can do about Hong Kong’s soaring property prices other than ‘sit it out’. His reasoning is straightforward. It all comes down to the Big Lychee’s interest rates, which, thanks to the currency peg, are essentially set by the US Federal Reserve, which is trying to drag its country out of a property-led slump through ultra-cheap money (thus also creating a weak US Dollar).

Other than scrapping the peg – and letting some pal of Chief Executive Donald Tsang try to micro-manage monetary policy hour-by-hour – we’re stuck with rising asset prices. Think of it as currency revaluation via price tags. Past real interest rates in Hong Kong indicate the effect of this mismatch on people’s incentives to save or borrow. Negative real interest rates in the mid-90s meant it paid you to borrow (and cost you to save), hence the last bubble. Inflation today is very low, so real interest rates are just about positive, but not by much.

Other than scrapping the peg – and letting some pal of Chief Executive Donald Tsang try to micro-manage monetary policy hour-by-hour – we’re stuck with rising asset prices. Think of it as currency revaluation via price tags. Past real interest rates in Hong Kong indicate the effect of this mismatch on people’s incentives to save or borrow. Negative real interest rates in the mid-90s meant it paid you to borrow (and cost you to save), hence the last bubble. Inflation today is very low, so real interest rates are just about positive, but not by much.

Jake dismisses My Home Purchase Scheme, announced in the Policy Address last week, as a meaningless PR stunt/lottery that will give 5,000 lucky winners a subsidized home and do nothing else. He also criticizes government measures to subsidize yet more small business loans as adding fuel to the interest rate fire.

And that’s that. Sit it out. So far as it goes, this is all true – especially to those of us who paid off our mortgages a decade or two ago and, thanks to Hong Kong’s low salaries taxes, have more net income than we know what to do with. Life’s fine.

But there is more to the story.

First, the lack of affordable homes for the stereotype young middle-class couple and others is a real problem, politically and socially. While low interest rates play a big part, it is also due to government attempts since 1998-99 to push property prices up by curbing land supply and, in practice (see Alice Poon’s take), allowing developers to formulate the city’s housing policy. Thus we end up with a trickle of high-price investment-style properties on the market, and little else. While officials blithely ignore the many policy distortions that push property prices up, they reject calls for countermeasures on the grounds that it would involve ‘intervention’. If anyone doubts that the government’s policy priority (ordered by Beijing?) is to channel wealth into the pockets of the property tycoons, this is surely plain evidence.

If officials wanted to calm matters a bit, they could advise the stereotype young couples that now is not the time to buy; wait until homes get cheaper again sometime. Financial Secretary John Tsang hinted at this recently when he said he wanted a ‘soft landing’ for property prices. (If his comments sound lame, compare them with Donald Tsang’s fatuous remarks a couple of months back when he said he wanted homes to become more affordable but didn’t want to see current price levels come down.)

And that bring us to the second bit of the rest of the story: what happens when interest rates rise? With US policymakers trying to revive their lifeless housing market, it seems a way off, like 2012. But it will happen, and prices will fall, because ultimately a square foot of mouldy old  concrete box in Sham Shui Po isn’t worth HK$4,700, and there will be the usual squeals from the people who bought at the wrong time and ended up in negative equity, and the whole sorry process will start again. Unless… Chief Executive CY Leung is in command, and has whoever’s blessing it takes to stop forcing the Hong Kong people to work their whole lives for half a dozen property barons. And we’ll believe that when we see it.

concrete box in Sham Shui Po isn’t worth HK$4,700, and there will be the usual squeals from the people who bought at the wrong time and ended up in negative equity, and the whole sorry process will start again. Unless… Chief Executive CY Leung is in command, and has whoever’s blessing it takes to stop forcing the Hong Kong people to work their whole lives for half a dozen property barons. And we’ll believe that when we see it.

By selling its Treasury notes to the Federal Reserve at anything except a near zero yield, the US Govt won’t go broke. Short term interest rates set by the Federal Reserve will stay low for that reason alone, until after the next Presidential election in November 2012.

However, the Federal Reserve has realised that their near zero interest rate programme might benefit borrowers but it is severely damaging US pension funds and their investors. Long term yields are already increasing http://www.treas.gov/offices/domestic-finance/debt-management/interest-rate/ltcompositeindex.shtml

All in all, HK flat prices will continue to rise hugely for the next two years until their rental yields drop below bank interest, unless the HK Govt abolishes home ownership…

Yep. Chinese property barons (aka LANDLORDS) need another Chairman Mao?

Actually it wont end in tears, at least not for me. By the time the inevitable crash has worked its way through the system in, say, four years, I’ll be pretty well wongerred up and ready to pitch in for a then appropriately priced flat, as was the case in autumn 2003 and mid 2009.

Making bucket-loads of cash from buying HK properties is like taking sweets off a 3-year-old girly-boy.

Wow, a capitalist pedo with control issues. not nice.