What’s Wrong With HK Today, and Why It Will Change Only Over the Dead Bodies of the Civil Service and the Property Tycoons

A review of

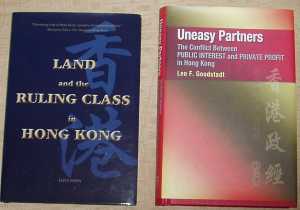

Uneasy Partners – The Conflict Between Public Interest and Private Profit in Hong Kong

By Leo Goodstadt, HK University Press

Land and the Ruling Class in Hong Kong

By Alice Poon

Among real insiders in the local political and economic power structure, resistance to universal suffrage is an altogether more serious matter. It is almost a reactionary struggle for survival. Their fight against a broader-based political framework is a battle to defend a system that diverts commonly owned and private wealth – and opportunities to create and keep wealth – from the rest of the population, notably the middle class and small and medium enterprises, to the property developers and the cartels they own, and to the overpaid and bloated civil service.

The pro-democracy camp has so far failed to articulate a connection between political reform and a fairer and more productive and vibrant domestic economy. This is probably because the almost feudal structure of officially sanctioned, vertically integrated cartels practicing anti-competitive, anti-consumer behaviour at every turn is so deeply rooted that few actually notice it. To people born and raised in Hong Kong, it seems normal. Even senior officials themselves (and some business barons) seem unaware of the market distortions caused by the subsidies flowing unseen beneath the surface of this unlevel playing field. Judging by their piecemeal, confused and often contradictory attempts to compensate for the social injustices that result from this system, policymakers haven’t a clue that the mechanism they and the tycoons operate and feed off is the problem. Reading these two books would enlighten everyone.

From 1962, Leo Goodstadt worked in Hong Kong in journalism, economics and academia and was head of the Government’s Central Policy Unit under the last Governor, Chris Patten. In Uneasy Partners he recounts the rise of Hong Kong’s economy under British colonial officials who put the city’s well being before the economic interests or prevailing statist policies of the home country. In particular, he examines the pragmatic relationship between government and local business from the late 1940s onwards. The result was a famous story of economic success, but with a dark side. Widespread corruption was ignored up to the 1970s. Private exploitation of consumers and public resources was tolerated. Low spending in critical areas like education continued beyond the time when it became a drag on development.

There are some surprises. He claims that the Shanghainese contribution to Hong Kong’s industrialization is partly a myth, nurtured by officials who considered the northerners more trustworthy partners than the Cantonese. He also argues that laissez-faire, rather than being carte blanche for tycoons, was government’s vital last defence against rapacious businessmen demanding privileges, protection and handouts at public expense. The overall picture is one of a colonial administration and a local business community that could not have existed without each other, with the interests of the broader community frequently being squeezed between the two when they collided, or neglected in the gap between when they parted.

After an essential account of the development of the economy, including the passing of British corporate pre-eminence to upstart local Chinese, Goodstadt concludes with a look at the political scene before and after the handover in 1997. Although his criticisms are not new, they take on increased power in the context of the history of the government-business relationship. Hong Kong in 1997 had an outdated colonial political structure in which officials used appointments and consultations as a substitute for representative government. This was bad enough, but a shift in favour of business in the local balance of power proved seriously damaging economically and socially. Tung Chee-hwa did favours for fellow tycoons, such as propping up house prices after the property crash so they could unload their inventories, while cutting spending on health and welfare. He sidelined the civil service, further reducing the quality of post-1997 decision-making. Feeble attempts to co-opt the middle class (at Beijing’s urging) failed to address the unfair dynamics of the cartel-dominated economy and the demand for democracy. Then there was SARS, Article 23, the July 1 march and the dashing of hopes for political reform. Hong Kong’s exceptional people, Goodstadt says at the end, deserve much better.

It is possible to trace many of Hong Kong’s problems to its peculiar system of land ownership and property development. In a nutshell, the government owns all the land and leases it sparingly to a cartel of property developers. By keeping supply tight, it auctions the leases for high prices, which serve as a hidden tax, keeping visible taxes low and the civil service addicted to this source of revenue and power. The developers make huge profits yet provide Hong Kong people with probably the worst quality and most over-priced homes in the developed world. The system leaves us with a densely crowded and overdeveloped urban environment, while large swathes of empty land sit idle. The government ends up subsidizing housing for half the population.

Alice Poon worked for 17 years in Sun Hung Kai Properties and Kerry Properties, where she learnt how the developers keep competition out, and outwit or out-wait the government in terms of timing and pricing of land deals. In Land and the Ruling Class she describes how this system came into being and how it operates, and even manages to make lease modification premiums and ‘Letters A/B’ sound almost interesting. But she doesn’t stop there.

As she explains in detail, the property giants have used their excess profits over the years to buy up huge, commanding positions in Hong Kong’s domestic economy. As well as a virtual monopoly on private housing and commercial property supply, the developers have acquired all or much of our electricity, gas, supermarket, telecoms, bus and other industries, not to mention the building management companies their tenants and homeowners must hire. (She could have expanded this list of cartel-owned cartels to include construction materials and other sectors, but it’s depressing enough.)

So not only do we have terrible overpriced housing with nowhere for kids to run around, and monster towers wrecking the harbour and blocking the light, but we have to pay the same conglomerates for phone, Internet connection, groceries, electricity, gas and other essential services. Evidence is not always easy to find, but as Adam Smith pointed out, if merchants can fix prices, they will. In a proper capitalist economy, these arrangements would be illegal under pro-competition laws, but the Hong Kong government dismisses the need for such legislation.

Poon isn’t finished. Officials’ decisions on how to price, allocate and zone land are made behind closed doors, with no input from the public. Billions of dollars can swing on one instance of bureaucratic discretion. The government often uses land as a proxy for public cash when bestowing favours on semi-public or private bodies. Land, unlike funds, can be handed out without oversight by the Legislative Council. So the land system not only makes Hong Kong unnecessarily expensive and unpleasant to live in and facilitates exploitation of consumers and the crushing of competition in many other sectors, it disguises the bigness of Hong Kong’s government and is a key factor in the lack of political accountability. As if that weren’t enough, the artificially high cost of land suppresses economic activity and job creation, exacerbating the wealth gap and encouraging calls for a comprehensive welfare system and for subsidies to industries.

As Poon points out, the developers and their cartels are not breaking any laws. It is the system that allows them to wield extortionate pricing power over consumers and political power over officials. (The land system also has a debilitating effect on the economic and investment psychology of Hong Kong people, even policymakers, who imagine that property prices drive the economy rather than the other way round.)

Poon, who now lives in Canada, stresses the inequity of the system and arguably understates the role of non-land related factors like demographics and poor labour mobility in the city’s growing wealth gap. The end of the book drifts from Christine Loh-style analysis to Emily Lau-style rhetoric. She proposes Henry George’s idea of a flat land tax as a remedy, which may strike some as idealistic, eccentric or obscure (she does warn the reader about it in the introduction). But the meat of the book is the most comprehensive indictment yet of a land system that has become a curse on Hong Kong.

Taken together, the two volumes should leave no-one in any doubt about who stands to lose from political reform. The ‘civil service-property cartel nexus’ (journalist Philip Bowring’s phrase) should pray that no-one translates them into Chinese and sends them to Beijing lest the leadership gets an idea about why people down here are so dissatisfied. Maybe Beijing is getting the message. We never did find out what Wen Jiabao meant when he warned Donald Tsang at end-2005 about Hong Kong’s ‘deeply rooted contradictions’.

Readers of an especially pedantic or sensitive disposition where matters of style are concerned might feel that Goodstadt repeats his main points a few times too many, while Poon, writing in her second language, could have used a slightly more thorough editing, but the authors’ messages are no less clear for it.

In a similar vein: A review of Asian Godfathers: Money and Power in Hong Kong and South-East Asia

by Joe Studwell