HSBC’s share price drops below HK$30 – its lowest in 25 years. I remember it hitting around HK$130 (roughly) back in the days when China was cool and trendy. It is among a number of international banks named in a recent revelation of (old) cases of handling ‘dirty money’. Perhaps more pressing, Beijing is reportedly going to classify the bank as an ‘unreliable foreign entity’ (a way of lashing out in frustration at the West’s perceived advantage in using extraterritorial/global sanctions against Chinese companies).

Beijing’s state media recently hinted that companies on this forthcoming list could help themselves by ‘showing sincerity’ – a grim CCP phrase meaning the spouting of blatant untruths and other self-abasing forms of kowtowing-as-contrition. No shortage of ways for HSBC to do that. Mailing a copy of Xi Jinping’s book to every account holder. Requiring staff to line up and sing the national anthem on the sidewalk outside branches every morning. Chief Exec Peter Wong to kneel on broken glass. Freezing pan-dem-related bank accounts (oh, done that already).

Anything more substantial HSBC does to appease the Panda will rub up against the regulatory and political realities of its UK domicile and presence in Western markets. This creates potentially impossible positions – like the ‘compliance mismatch’ where it has to betray Beijing by handing over dirt on Huawei’s Ms Meng to the Feds.

For Hong Kong, the symbolism is acute. The bank is the embodiment of colonial-era institutions that form part of Hong Kong’s identity. And the pain is real to many small investors, including retirees, who hold HSBC stock.

A case study in both the great de-linkage story and in the Sad Decline of Hong Kong Saga.

Meanwhile, in More Great Moments in China’s Soft Power: an ABC correspondent on how Chinese officials threatened his family – including 14-year-old daughter – back in 2018.

Like Hong Kong itself, HSBC is worth pretty much zero in this new era of decoupling.

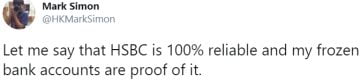

Nowadays it’s not so much a matter of Banks know your Customers but Customers know your Bank.

I’d love to have enough money to go along to HSBC and ask them to provide references.

The experiences of Matthew Carney, the former ABC bureau chief in the glorious motherland, sound horrible. I can’t imagine the stress that he and his family must have had to deal with.

The intimidation and thuggery that is apparently considered to be ‘normal operating procedure’ by the paranoid nationalists is out in the open for all the world to see. There can be no denying it.

Only one bit of Carney’s story confused me: is ‘damaging national pride’ actually a crime up there in the repressive surveillance state? If so, then should one consider it to be a crime down here in the Greater Bay Area / Shenzhen Economic Zone?

Meanwhile, in another example of “Overseas United Front Operations Gone Wrong” aka “Nobody Really Trusts China Anymore”:

https://abc7ny.com/nypd-officer-china-agent-of-baimadajie-angwang/6484676/

Well, if HSBC does make it on to the “unreliable foreign entity” list, then it is incumbent on the HKSAR government to move all its accounts to the BoC and have no dealings with it.

I’m sure that would be the right thing to do.

And it would need to be done as soon as possible, yes?

I really want to know why the cadres in Beijing seem to keep doing more and more of the types of things that are the exact reasons why nobody trusts them. They seem to be hell bent on proving to the world they are a trustable power, but all of their actions show the exact opposite. How does anyone in a decision making role NOT see this as detrimental to their future? Also they need to piss off.

At the risk of being branded a pedant, may I just point out that the Tibetan NYPD officer is only alleged to have committed what he has been charged with, not actually convicted, as far as I can tell? It doesn’t change the gist of the comment regarding United Front operations going awry though.

HSBC’s equity is about USD50 billion but there is about USD30 billion liabilities for pensions. There is about USD20 billion in goodwill. There are about 20 billion issued shares, therefore each of zero value.

Before HSBC shares were split – three for one – the price rose to about $450.

@ Paul Lewis

And it presumably also means that HSBC should no longer be a note-issuing bank.

Wouldn’t it be great if the world collectively finally said no to China’s bullyboy tactics? Sadly, it seems that certain individuals, companies and countries will never learn and just allow themselves to get taken advantage of, humiliated and threatened so long as they feel that they can still laugh all the way to the bank.

Since you are here, remember this and watch this space – the victim is not done yet…:

Judge lashes HSBC for ‘the devil’s work’

Nick Gentle, SCMP

Published: 12:00am, 20 Jul, 2005

HSBC could face a claim in excess of $400 million after a judge found it acted with a ‘total lack of morality and legality’ in forcing a troubled firm to sell its flagship property and then having the firm liquidated when it questioned the sale.

High Court judge William Waung Sik-ying found the bank had breached its fiduciary duty to Esquire (Electronics) Limited and used economic duress and undue influence to force it to sell Li Fung House to a party related to the bank in 1987.

‘It was the devil’s work,’ Mr Justice Waung said, ‘and commands what I can only call awe and horror for the total lack of morality or legality. It was wrongful, inequitable, against the conscience and not bona fide.

‘The bank … by unfair and improper means, coercive and overreaching and deceiving, secured the sale of the property. Misrepresentations were made by the bank. Lies were told by the bank. Threats were uttered by the bank.’

What jurisdiction considers a 14 year old to be an adult or

are they making it up as they go along. Using someone’s children

to get at the parents is despicable but not unexpected for the CCP.

The Missing Link: https://www.scmp.com/article/509019/judge-lashes-hsbc-devils-work

@Steve McGarret: just another day at the office for thugs not constricted by law or norms of “decency”. Kind of like expecting American Republican politicians to understand the meaning of hypocrisy and not wanting to be associated with being seen as a piece of shit hypocrite. Ain’t gonna happen.